Loan Lending App Development - A Complete Guide with Cost, Features and Steps and Pros and Cons. Mobile apps have been a part of our day-to-day lives and with technology being an important part, it has made things hassle-free which also includes the loan lending process. The amalgamation of technology into the loan lending process not only automates the process but also makes the services more accessible to the customers alongside an easy-to-use interface.

And with the growing demand for loan lending app development, investing in one such application is the right decision to make.

So, if you are interested in developing a loan lending app then this blog is for you, and without any further delay let’s get started!

Read: Software development

Loan Lending App Development

Loan lending app development is the process of developing mobile applications that help in borrowing and lending money digitally. It is the bridge between the borrowers and the lenders, where the borrowers can request a loan from the lender and then when the lender approves the request, the amount gets disbursed automatically without having to visit physical branches and other financial institutions.

Read more: Financial Software Development Cost

Some of the different types of loan lending apps are Personal loan apps, Payday loan apps, Peer-to-Peer (P2P) lending apps, Mortgage loan apps, Student loan apps, Business loan apps, Crowdfunding loan apps, Microfinance apps, and many more.

Calyx, CloudBankin, Finflux, TurnKey Lender, FIS loan management system, CashE, Dhani, BankPoint, and MoneyTap are well-known examples of loan apps and software that are widely used in the market.

Loan Lending App Development: Pros and Cons

Loan lending app development caters to innumerable benefits both to businesses and their customers, specifically in the finance industry or in the fintech sector.

Benefits of developing a loan lending app

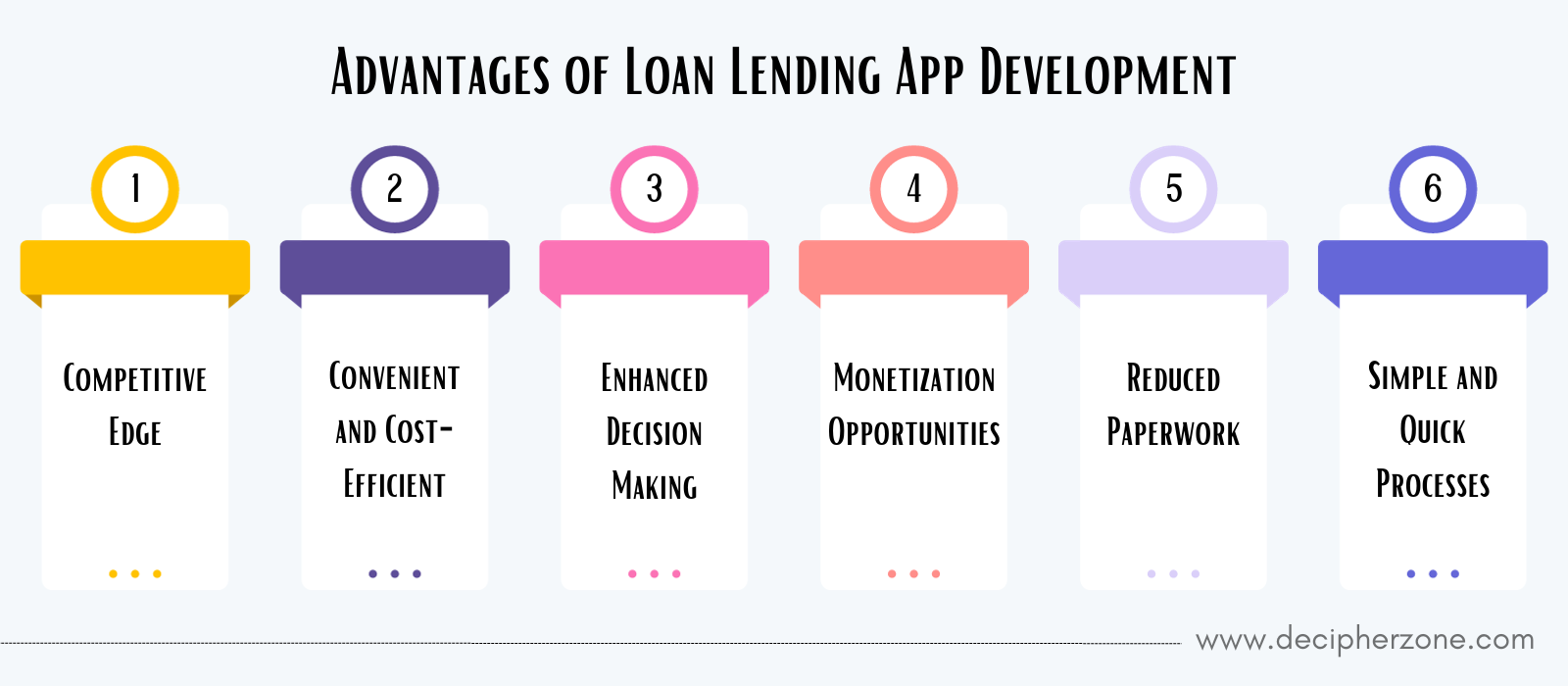

Here is the list of advantages of Loan Lending App development

-

Competitive Edge

-

Convenient and Cost-Efficient

-

Enhanced Decision Making

-

Monetization Opportunities

-

Reduced Paperwork

-

Simple and Quick Processes

Read more: Top FinTech Industry Trends

1. Competitive Edge

The first and foremost benefit of developing a mobile application for any business is that it helps you gain a competitive edge in the market. Similarly, loan lending app development also helps you gain a competitive advantage in the market as it enables your business with automation alongside making your business accessible to potential customers anytime and anywhere, without having to visit the financial institutions physically, thus saving time, effort, and money.

Read more: Top 10 Latest Banking Trends for 2023

2. Convenient and Cost-Efficient

Loan lending app development makes your business services more convenient to the users by enabling them to apply for loans and check for the approvals and disbursement of amounts on their smartphones, making the application process hassle-free alongside making it a cost-efficient process.

In addition, it also helps in reducing infrastructure costs, and operational costs and also helps in reducing manual labor which further makes it a more cost-efficient option for your business.

Read more: Enterprise Accounting Software Development - Benefits and Steps

3. Enhanced Decision Making

It also helps in enhancing the decision-making process by providing detailed analysis and reports on your business and its performance, which further allows you to make amendments to the application and improve it accordingly to provide better services to your customers, which in turn increases the positive feedbacks, thus helping you make informed business decisions.

4. Monetization Opportunities

Developing a mobile application for your loan lending business also brings innumerable revenue generation streams for your business by enabling you to integrate different monetization models into your application, thus increasing the ROI and accelerating your business growth.

Read more: Top Mobile App Monetization Strategies to Consider

5. Reduced Paperwork

Loan lending app development helps in reducing the paperwork as it automates the process and minimizes the manual labor, which in turn makes the loan lending process more straightforward by providing a digital medium alongside reducing the risk of loss or theft of documents and other important paperwork as well as minimizes the possible errors.

Read more: Money Transfer App Development - Benefits, Features, and Cost

6. Simple and Quick Processes

It also makes the process easier and quicker with automation, which implies that the algorithms will automatically detect the user’s eligibility for a loan and disburse the amount quickly into the user's bank account, thus saving time and also aiding in enhanced customer service and retention rate.

Read more: Role of Blockchain in Fintech in 2023

Now that you are familiar with the pros of loan lending app development, it is also important that you should also learn about the cons of the same. This will help you devise a strategic plan to eliminate all the drawbacks in case you come across any and develop a high-performing and future-proof application for your business.

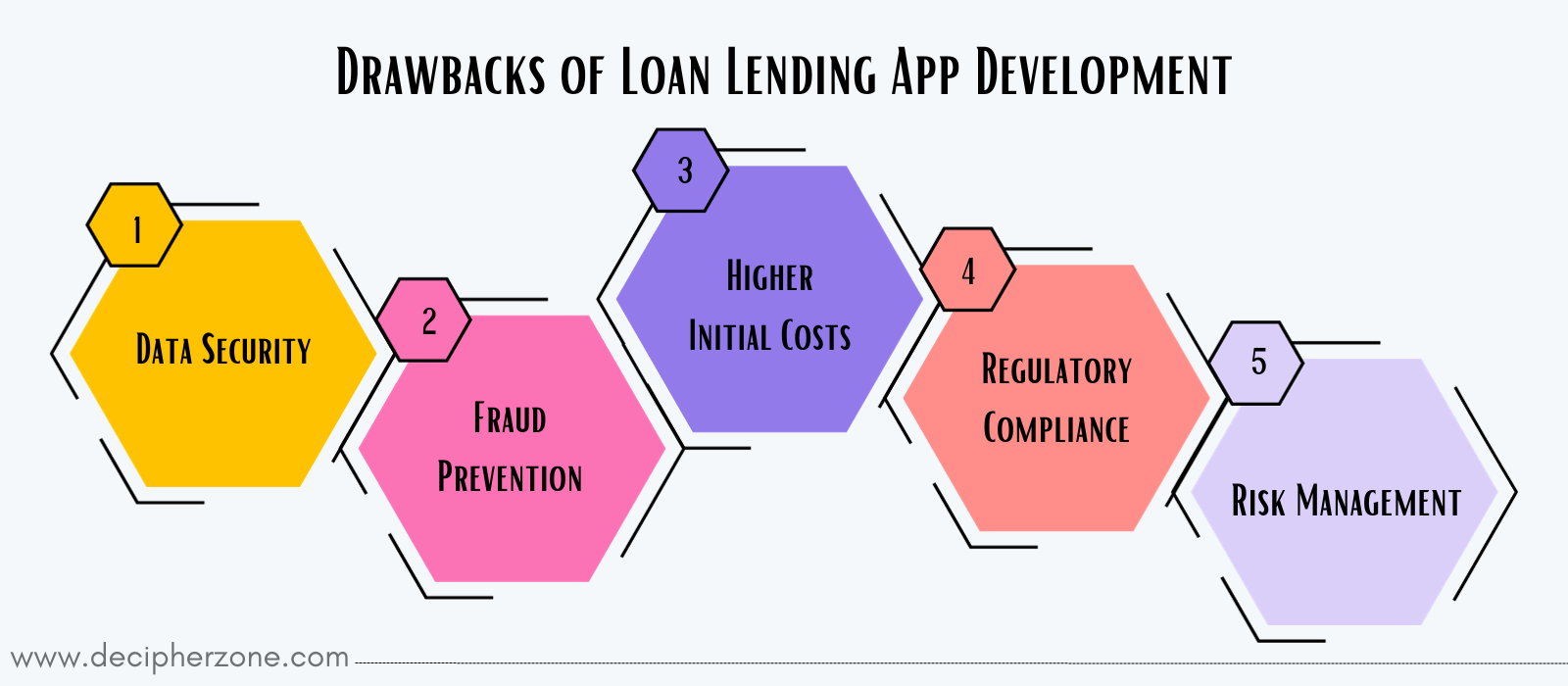

The cons of loan lending app development are -

-

Data Security

-

Fraud Prevention

-

Higher Initial Costs

-

Regulatory Compliance

-

Risk Management

1. Data Security

The primary drawback of loan lending app development is that ensuring data security and privacy can be a challenging task during the app development process, which includes sensitive customer data as well as their financial information.

Read more: What is Cybersecurity? Everything You Need to Know

2. Fraud Prevention

With digitization also comes the risks of online threats and cyber-attacks which could lead to fraud with the companies and the users so ensure that you implement strict fraud prevention measures like user verification, valid ID verification, and other authentication methods.

Read more: Fraud Detection Software Development

3. Higher Initial Costs

Loan lending app development can also lead to higher initial costs which would incorporate every minor cost as well like the marketing charges to the updates and maintenance costs, which might be pricey as a startup investment but once the app is developed and reaches its potential customers then you can easily generate revenue within no time.

4. Regulatory Compliance

Another potential drawback of loan lending app development is that your app should comply with the rules and regulations of the particular region to eliminate legal issues and penalties. So, before starting with the development make sure that you clear all the required paperwork and other necessary steps to comply with the laws, which will also help you build trust with your customers.

5. Risk Management

Loan lending apps involve a lot of risk and to evaluate and minimize the risks you need a robust risk management system, which can be challenging as well as a strategic process for your business.

Now that you are known about the pros and cons of a loan lending app development let us now move ahead and list out some of the must-have features in a loan lending app.

Must-Have Features to Integrate in a Loan Lending App

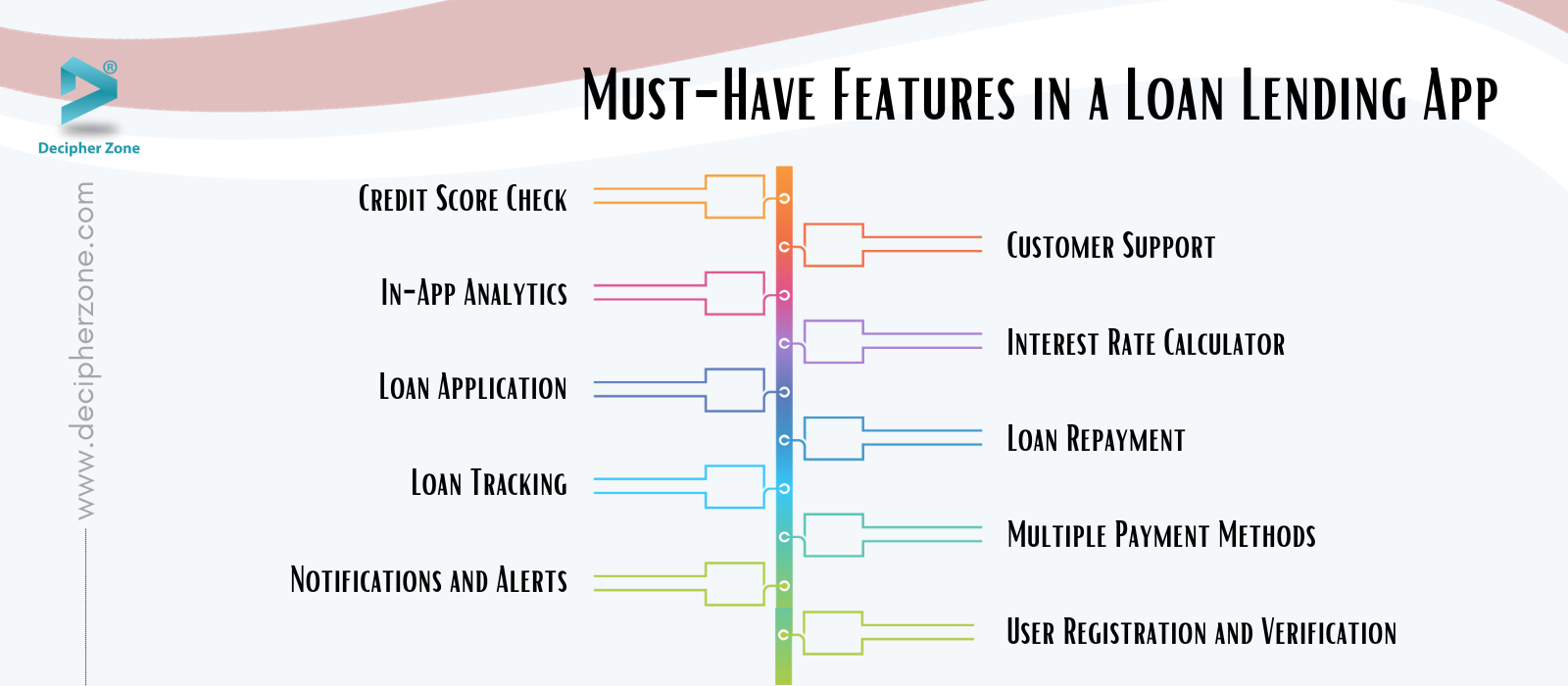

Some of the important features that you can consider integrating into the loan lending app are as follows -

-

Credit Score Check

-

Customer Support

-

In-App Analytics

-

Interest Rate Calculator

-

Loan Application

-

Loan Repayment

-

Loan Tracking

-

Multiple Payment Methods

-

Notifications and Alerts

-

User Registration and Verification

Features are an important USP that helps an app or a product stand out in the marketplace. When developing a loan lending app, make sure that the features that you integrate are not unique but also cater to the user and business requirements alongwith an easy-to-use interface.

Read more: Common Features of Mobile Apps and their Benefits

Credit Score Check - The users can check for their credit score with this feature along with their loan eligibility, which further also helps the users to enhance their credit score.

Customer Support - 24*7 customer support via in-app messaging and call request feature to enhance the user experience alongside answering frequently asked questions.

Read more: Cash Management System Development: Benefits & Cost

In-App Analytics - This feature caters to several tools to users that help them track and measure their financial health based on several parameters. In addition, these tools also help the business or the lenders to analyze user behavior and improve their overall services.

Interest Rate Calculator - This feature helps the users to calculate the estimate of their monthly payments based on the loan amount and tenure of the loan amount.

Loan Application - This feature enables the users to apply for loans, check their loan eligibility, and check for the loan status alongside providing the ability to set loan amount, tenure, and interest rates.

Loan Repayment - It helps users choose their loan repayment options as per their comfort by providing flexible loan repayment options, EMI payments, auto-debit payments, and many more.

Loan Tracking - This feature helps the users to track the real-time status of their loan application along with past loan application histories and repayment history.

Read more: Expense Management Software Development Cost, Benefits and Features

Multiple Payment Methods - This is a must-have feature to integrate into a loan lending app development that helps the users to make the repayment of the loan amount in their preferred payment mode like net banking, credit/debit cards, e-wallets, etc.

Read more: Payment Gateway Development - Benefits and Tips to Consider

Notifications and Alerts - This is another important feature of a loan lending app development that helps lenders send timely notifications and alerts about their upcoming payments, due payments, loan approvals, and disbursals, and other important updates about their loans.

User Registration and Verification - The user can register with different methods like using their mobile number or email address, and then upload the necessary documents to verify and authenticate their profiles alongwith all the important information like their bank account details and other personal information like their name, address, contact number, etc.

Read more: 7 Benefits Of An Integrated Security System

Now that you know some of the important features to integrate while developing a loan lending app make sure that you integrate advanced features as well, some of them that you can consider include WhatsApp Integration, Voice Search Options, Responsive Design, Social Media Integration, Biometric Authentication, Multi-language Support, and many more.

Loan Lending Application Development Steps

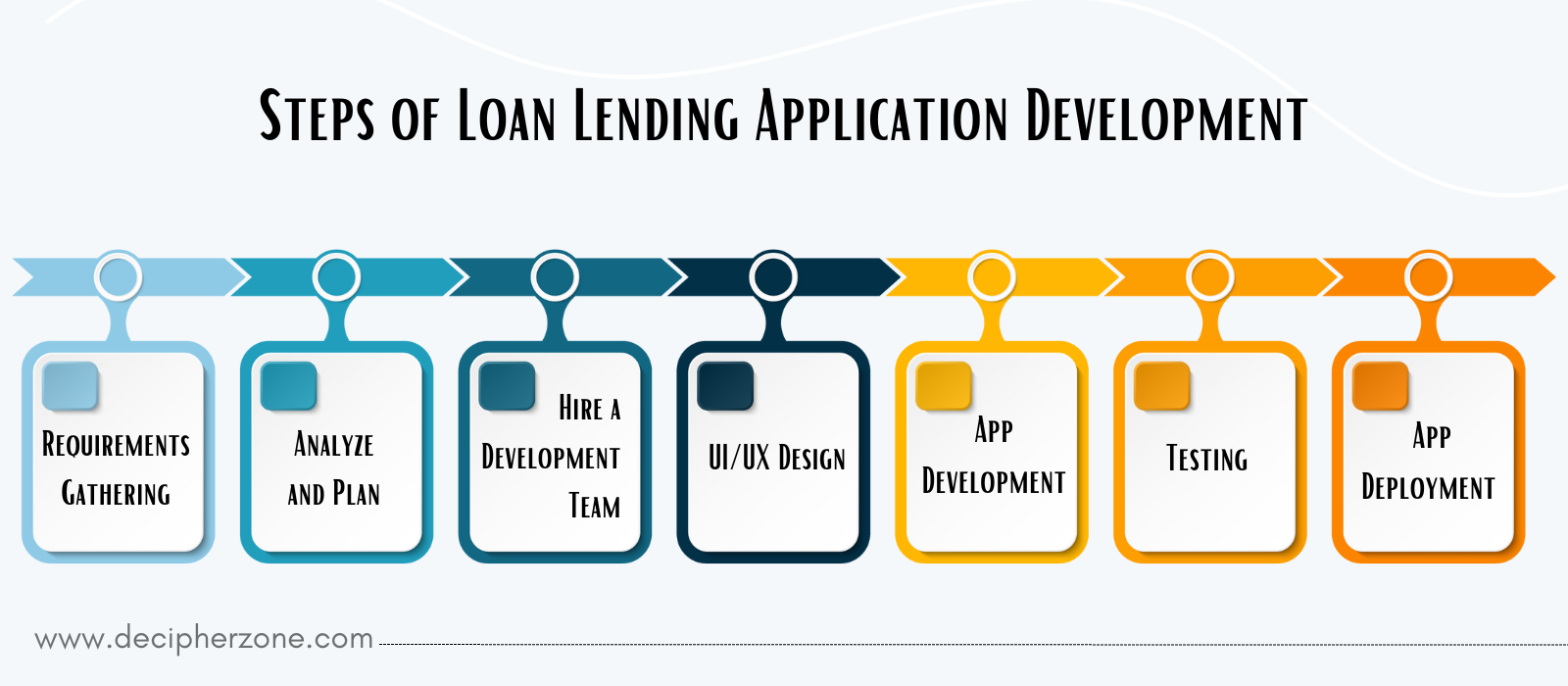

The 7 primary steps to develop a loan lending app include the following -

-

Requirements Gathering

-

Analyze and Plan

-

Hire a Development Team

-

UI/UX Design

-

App Development

-

Testing

-

App Deployment

Loan lending app development is a complex process and involves several steps to design and develop a fully functional and feature-loaded application.

-

Requirements Gathering - The first step is to define your business goals, and project objectives, and to identify your target audience alongside conducting thorough market research and competitor analysis.

-

Analyze and Plan - The second step is to analyze every aspect of your loan lending business and devise a plan accordingly that fulfills every aspect of your business.

-

Hire a Development Team - Next, hire an app development team and share all your requirements with them alongside selecting the technology stack, signing an NDA, and deciding the cost and timeline.

-

UI/UX Design - Once you hire the development team, they will start working on the design of the application i.e. the UI and UX design.

-

App Development - In this step, the developers integrate the features and functionalities into the design of the application along with various APIs, and other implementations, which is also known as programming.

-

Testing - After the app is developed it is further tested for quality assurance by the testers or quality assurance engineers who ensure that the app is bug-free and is performing seamlessly.

-

App Deployment - Once the app is tested and the necessary changes are made, the app is ready to be deployed on the desired platforms, making it available for the end-users followed by app maintenance and timely updates.

Read more: 10 Types of Bugs in Software Testing

Loan Lending App Development Cost

The cost of loan lending app development can start from as low as $20,000 and can rise to $2,50,000 and sometimes even more based on various factors.

The factors that influence the cost of loan lending app development include -

-

The type of app that you want to develop for your business, i.e. whether a Native app, Hybrid, Cross-platform, or Web app development.

-

The platform for which you want the apps i.e. Android, iOS, or both.

-

The tech stack includes programming languages, frameworks, libraries, plugins, and other tools.

-

The UI and UX design of the applications with the total number of screens.

-

The total number of features that you want in the app alongwith the complexity of integrating them into the app.

-

Third-party API licensing costs and integrations, alongwith additional security features and protocols.

-

The experience and expertise of the development team along with their location and hourly charges.

-

Different levels of app testing alongwith the timely maintenance and updates also add up to the cost of loan lending app development.

Read more: Mobile App Development Cost - A Comprehensive Guide

However, the price varies according to your specific business requirements, where an app with minimal features might cost you less as compared to an app with advanced features and tech stack. But do not worry, we Decipher Zone are here to help you develop the best apps at competitive rates.

Wrapping It Up

Loan lending app development is a complex process that requires thorough analysis, strategic planning, and an in-depth knowledge of the FinTech sector and the finance industry.

Now that you have reached here, it is likely that you are interested in developing a loan lending application for your business.

So, why wait?

Connect with us, or hire a developer, and get the best solutions tailored to your specific business needs to elevate your services and reach your potential customers easily.

FAQs about Loan Lending App Development

How does a loan lending app work?

Loan lending apps work by connecting the borrower to a lender via a digital platform, where the borrower applies for a loan, lenders access their eligibility and approve their loans, and later the funds are disbursed to the borrower electronically.

How much time does it take to develop a loan lending application?

Developing a loan lending application can typically take up to 20 to 25 weeks depending on some important factors like the total number of developers working on the project, budget, complexity, and so on.

What are the different ways to monetize a loan lending app?

The different ways to monetize your loan lending app are by charging processing fees, interest rates, service charges, and even subscription models.