Treasury Management Software Development - Benefits and Challenges. With the evolving scenario of the finance sector, it is essential to effectively and efficiently manage the treasury to ensure a company’s growth and success.

And with technology reshaping every industry, it has also catered to the finance sector with the advent of treasury management software. It not only helps in the efficient handling of cash flows but also helps with compliance alongside helping with streamlining their financial operations.

Read: Financial Software Development Cost

So, whether you're a business person seeking to optimize your business’s treasury functions or a developer looking to create innovative financial software solutions, this blog is for you.

Treasury Management Software Development

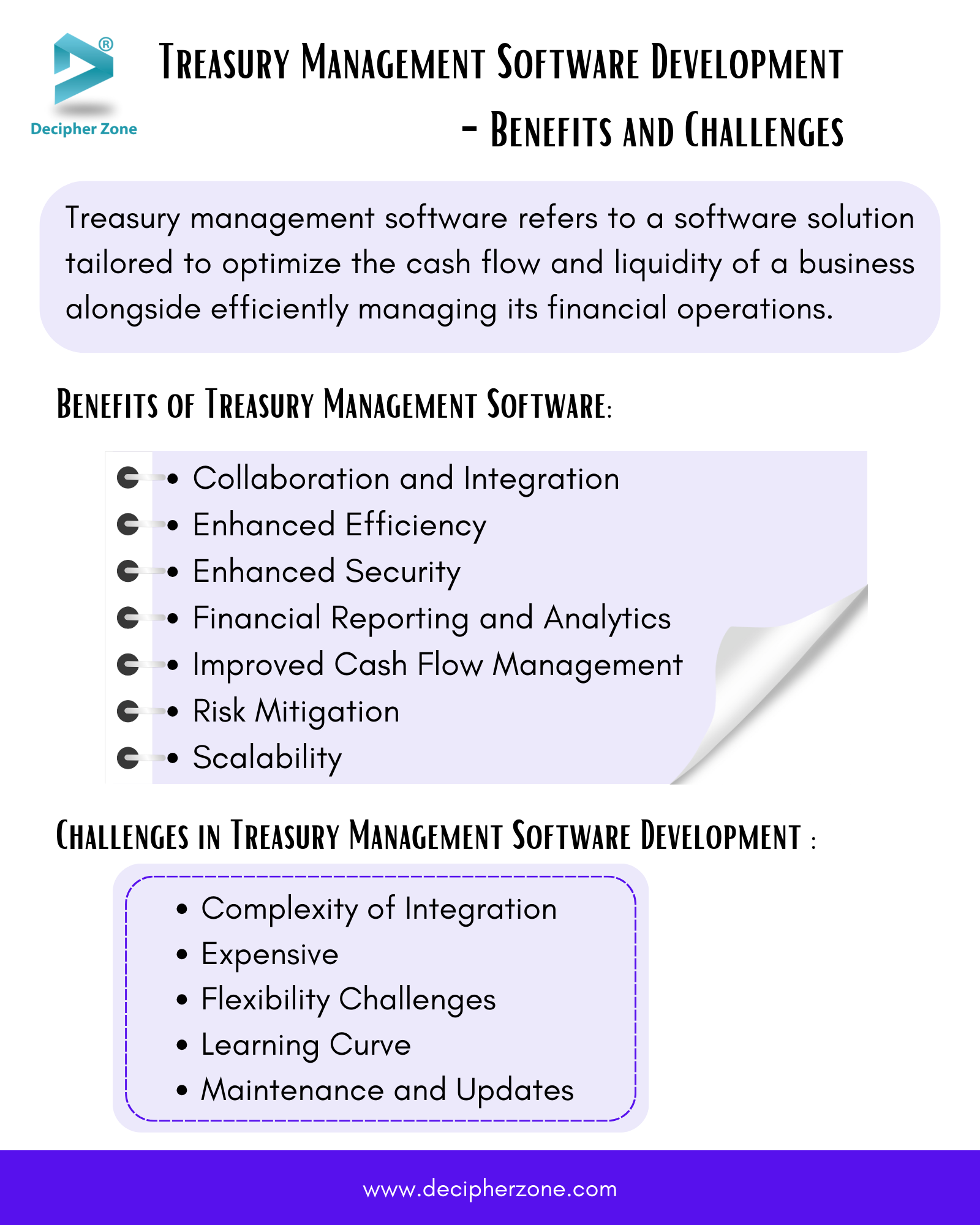

Treasury management software refers to specialized software tailored to optimize the cash flow and liquidity of an organization alongside efficiently managing its financial operations.

Fusion Treasury by Finastra, FIS Treasury and Risk Manager, Kyriba, City Financial by ION, Oracle Cash and Treasury Management, and SAP Treasury and Risk Management are examples of the best treasury management solutions available in the market.

Benefits of Treasury Management Software Development

Some of the advantages or benefits of developing treasury management software are as follows -

-

Collaboration and Integration

-

Enhanced Efficiency

-

Enhanced Security

-

Financial Reporting and Analytics

-

Improved Cash Flow Management

-

Risk Mitigation

-

Scalability

Treasury management software is a valuable tool for businesses and organizations as it offers a wide range of benefits alongside easing the decision-making process.

Read: Role of Blockchain in Fintech

Collaboration and Integration - The primary benefit of treasury management software development is that it can be easily integrated into other financial systems like ERP or accounting software, which helps ensure data integrity and facilitates collaboration with team members and external partners, thus leading to seamless communication.

Enhanced Efficiency - It helps in the automation of treasury management-related tasks which helps in making the process more efficient, error-free, quick, and cost-effective, which further helps in streamlining the workflows of the organization.

Enhanced Security - The treasury management system also helps provide enhanced security by incorporating advanced security features like multi-factor authentication, data encryption methods, and fraud detection algorithms which help ensure the confidentiality and integrity of the financial data alongside protection against fraudulent activities.

Read: Fraud Detection Software Development

Financial Reporting and Analytics - It also generates customized reports that help in providing detailed insights into your financial performance by identifying the trends and usage patterns, which in turn helps in making improved decisions.

Improved Cash Flow Management - Treasury management software also helps in providing real-time visibility of your cash positions, which helps you monitor and manage your cash flow easily alongside enabling accurate cash forecasting, which helps in optimizing investment and borrowing decisions.

Read: Money Transfer App Development - Benefits, Features, and Cost

Risk Mitigation - It helps in assessing and identifying various financial risks for your business like interest rate risk, currency risk, and many more, thus helping you to take proactive measures to future-proof your business.

In addition, it also helps in compliance with the financial rules and regulations alongwith other internal policies.

Scalability - Another important advantage of developing treasury management software is that it helps in making your business more scalable as per your business needs by accommodating increasing transaction volumes and complexity with several other business processes.

Read: Global Business Management Software Development

Now that you have understood the primary benefits of developing a treasury management solution, the next thing you need to know is the potential drawbacks and challenges that you might encounter during the development process.

Challenges in Treasury Management Software Development

Developing a treasury management system is a complex process and requires high levels of security, accuracy, and efficiency. Some of the challenges of treasury management software development include the following -

-

Complexity of Integration

-

Expensive

-

Flexibility Challenges

-

Learning Curve

-

Maintenance and Updates

Read: Software Development Challenges and Solutions

The complexity of Integration - The primary challenge in developing a treasury management solution is that integrating TMS with existing financial systems or other platforms can be a complex process, which requires an extensive set of technologies, resources, and development teams, thus making it a time-consuming process.

Expensive - It is an expensive investment to make for your business, as it incurs several costs like training, ongoing support and maintenance, licensing fees, and many more.

Flexibility Challenges - Treasury management solutions may also lack the flexibility to be able to adapt to the unique business requirements, thus making it a potential drawback to consider before developing one such software.

Read: Top 10 Software Vulnerabilities And How to Mitigate Them

Learning Curve - It has a steep learning curve, as users may not be familiar with using a TMS system before and would require training, thus negatively influencing the productivity of the employees.

Maintenance and Updates - Another disadvantage is that the treasury management software requires timely maintenance and updates to comply with the changing financial laws, making it a resource-intensive process alongside affects the financial operations of a business.

Read: How to Choose a Software Development Company

Wrapping It Up

To wrap it up, treasury management software development is a complex process along with myriad advantages to offer for your business. Although it has a few challenges as well, they can be eliminated with thorough research and proper planning and analysis. Furthermore, investing in the development of a TMS solution is the next big step to take if you want to enhance your financial goals and optimize your cash flows.

So, if you are looking forward to treasury management software development, then connect with us, or hire a developer to create the best solutions according to your requirements.

FAQs about Treasury Management Software Development

What are the major features of treasury management software?

The primary features of treasury management software are cash forecasting, bank account management, payments and transfers, investment management, risk management, compliance and audit trails, treasury analytics, and many more.

How much time does it take to develop treasury management software?

Developing treasury management software can take up to 20 weeks to 1 year and sometimes even more or less depending on your requirements, the complexity of the project, availability of resources, budget, and many more.

What is the cost of treasury management software development?

The cost of treasury management software development can vary from $45,000 to $3,50,000 and might increase even more depending on factors like the design and complexity of the software, total number of features and functionalities, licensing charges for third-party API integration, technology stack, development team, and so on.