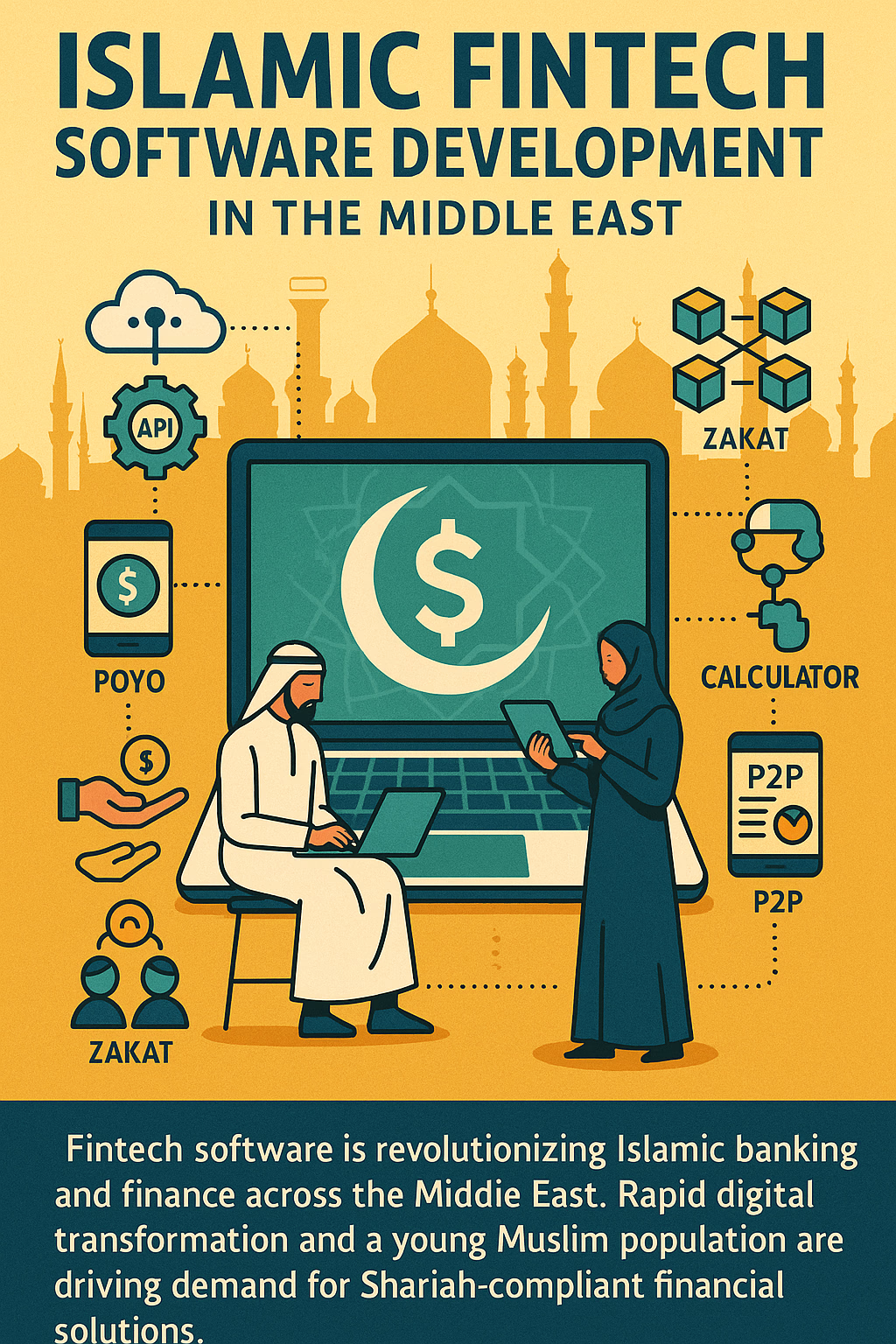

Fintech software is revolutionizing Islamic banking and finance across the Middle East. Rapid digital transformation and a young Muslim population are driving demand for Shariah-compliant financial solutions. Developers are harnessing cloud-native, API-driven architectures, open banking, AI, blockchain and RegTech to build modern Islamic finance platforms.

Key opportunities include expanding digital services for unbanked segments, mobile banking, and new products like peer-to-peer (P2P) lending and automated Zakat calculators. Challenges include integrating legacy systems, ensuring Shariah compliance (no interest or forbidden industries), navigating diverse regulations, and earning customer trust.

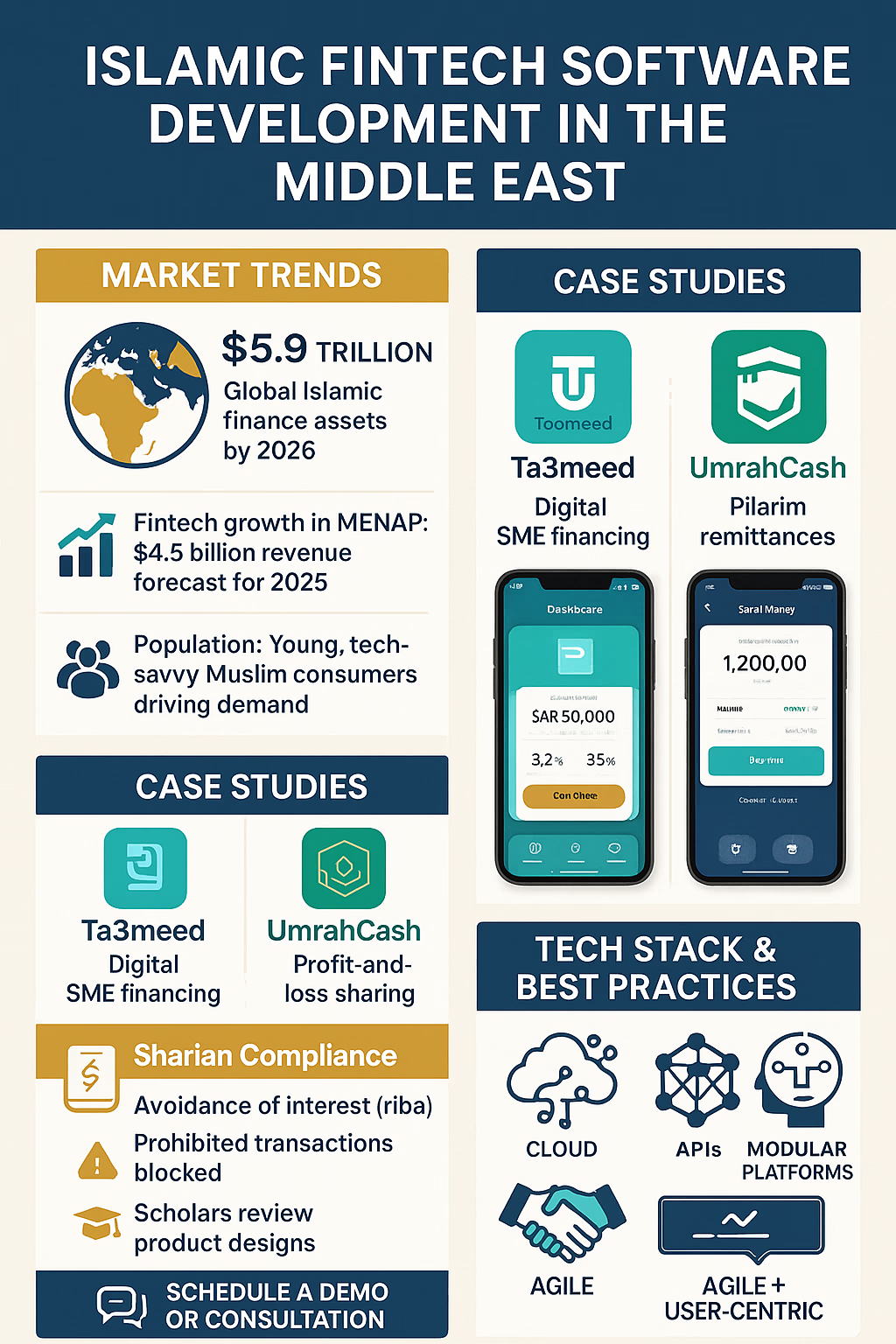

By leveraging agile development, modular core banking engines, and automated compliance tools, fintech startups and banks can rapidly launch innovative Islamic finance apps. Real-world examples like Ta3meed (digital SME financing) and UmrahCash (pilgrim remittances) show how software can align with Islamic principles while driving financial inclusion.

Below we explore market trends, technologies, and strategies for successful fintech development in Islamic banking, tailored to startups, banks, investors and developers looking to innovate in this space.

The Opportunity in Islamic Fintech

The Islamic finance sector is huge and fast-growing. Recent reports estimate global Islamic finance assets will reach $5.9 trillion by 2026. In the Middle East, fintech markets are booming – for example, fintech revenues across the MENAP (Middle East, North Africa, Pakistan) region could hit $4.5 billion by 2025. Saudi Arabia alone had an $18 billion Islamic fintech market in 2020.

This growth is driven by a young, tech-savvy population: Muslim consumers have an average age of 24 and are projected to make up 26.4% of the world’s population by 2030. Digital transformation initiatives (like Saudi Vision 2030) and government support (new fintech regulations, sandboxes) are also accelerating development.

For fintech startups and banks, this means vast opportunities in areas like mobile banking, digital lending, microfinance, and payments—all designed to comply with Shariah (Islamic law). For instance, survey data shows 89% of Islamic finance professionals believe fintech has already made Islamic banking products more accessible globally.

Fintech can help Islamic banks offer innovative services (digital wallets, P2P lending, cloud-based core banking) that attract younger customers and extend financial inclusion to previously underserved Muslims.

Read: Future of Banking

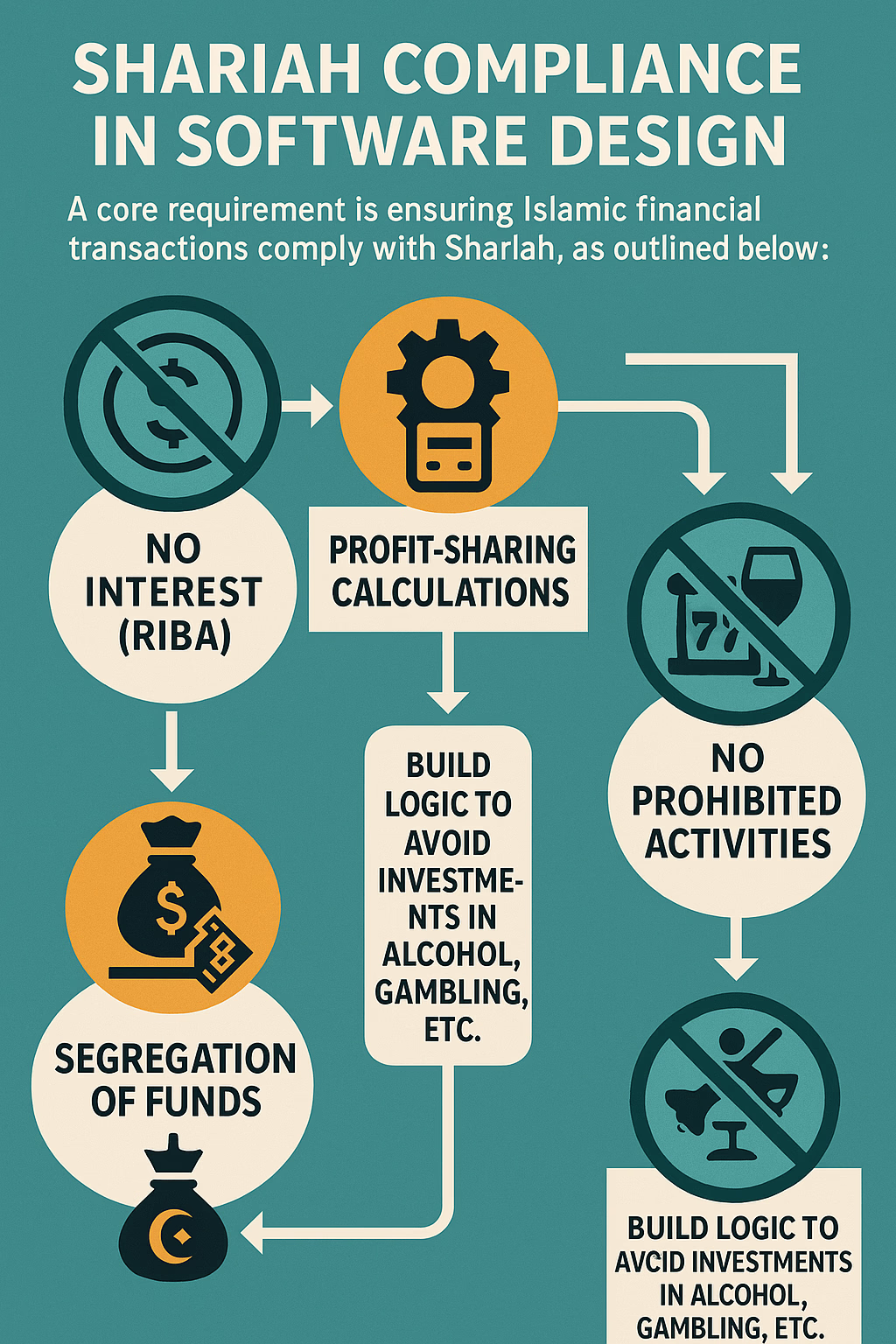

Shariah Compliance in Software Design

A core requirement is Shariah compliance. Islamic banking forbids interest (riba) and investments in certain sectors (alcohol, gambling, etc.). Instead, Islamic banks use profit-and-loss sharing and asset-backed contracts (e.g. murabaha, mudarabah, ijara). Fintech software must enforce these rules.

This means building products that support profit-sharing calculations instead of fixed interest, avoid prohibited transaction types, and segregate funds when necessary (operational separation of Islamic vs conventional funds).

Modern core banking platforms like Mambu and Tuum offer pre-built modules for Islamic funding (Wadiah, Mudarabah) and financing (Murabaha, Tawarruq).

These platforms use APIs and configuration tools so developers can rapidly launch Shariah-compliant accounts, loans and investment products. For example, Tuum’s cloud-native suite automates Islamic profit-sharing and Tawarruq contracts, ensuring real-time compliance with AAOIFI standards.

In practice, fintech teams work with Shariah scholars to map Islamic finance principles into software logic. Automated compliance engines and audit trails (RegTech) can verify all transactions meet local Shariah and regulatory rules.

In short, software architects must bake Islamic business logic into every layer: data models, transaction flows, user interfaces and reporting, so that every digital feature “remains true to Shariah principles”.

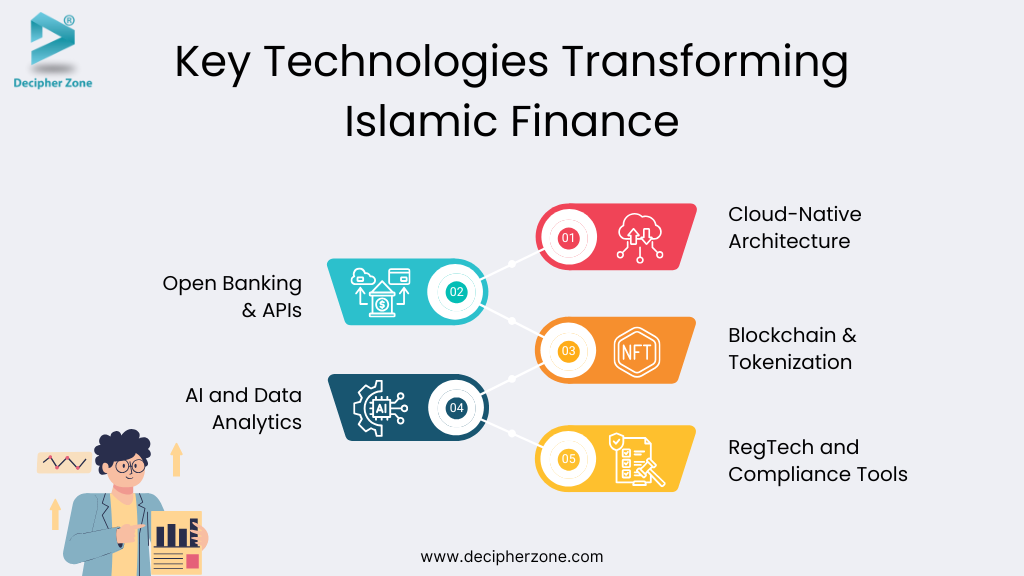

Key Technologies Transforming Islamic Finance Software Development

Fintech development today is driven by cutting-edge tech. In Islamic finance, several trends stand out:

-

Cloud-Native Architecture

-

Open Banking & APIs

-

Blockchain & Tokenization

-

AI and Data Analytics

-

RegTech and Compliance Tools

1. Cloud-Native Architecture

Modern Islamic banking systems are built on microservices and APIs. Cloud-native platforms allow banks to scale quickly and deploy new products in weeks, not years. Hyperscalers (AWS, Google Cloud, Azure) now offer data centers in the Middle East, enabling banks to host sensitive data regionally for compliance.

For example, Google opened a cloud region in Saudi Arabia to power fintech innovation. Cloud-based development accelerates digital banking, as seen with Ta3meed (an Islamic SME financing startup) using Mambu’s SaaS core to automate Shariah-compliant lending.

2. Open Banking & APIs

Regulators in the GCC are rolling out open banking frameworks (Bahrain 2020, KSA 2020, UAE open finance 2024). Open APIs let fintech apps plug into traditional banks. This connectivity is a game-changer for Islamic fintech: apps can aggregate customer data (with consent) and offer personalized Shariah-compliant services.

For instance, an Islamic bank using open APIs could analyze a user’s spending to auto-invest in Sukuk or halal equity funds aligned with their values. A 2022 survey found 90% of Islamic finance professionals expect widespread open banking adoption by 2025.

Practical use cases include automated Zakat calculators (charitable giving) and digital Waqf platforms that draw on real-time account data. In development terms, fintech teams must design robust APIs, OAuth security, and data-sharing consent flows that respect both privacy laws (e.g. GDPR) and Shariah data handling norms.

3. Blockchain & Tokenization

Distributed ledger tech (DLT) is gaining traction. Islamic fintech innovators are exploring blockchain for transparent, asset-backed financing. For example, platforms like Takadao use blockchain to enable peer-to-peer mutual insurance (Takaful) without a central insurer. Startups are also investigating stablecoins and asset tokens as “decentralised money,” aligning with Shariah views on gold-backed currency.

Schedule a Free Consultation with Our Islamic Finance Experts

Smart contracts can automate Islamic contracts (e.g. releasing funds only when predetermined halal conditions are met). From a development perspective, this means integrating DLT frameworks (such as permissioned chains) with core banking.

The technology is still emerging, but developers should consider how tokenization can streamline Islamic trade finance and sukuk issuance, ensuring full auditability.

4. AI and Data Analytics

Artificial intelligence is increasingly used in fintech and is relevant for Islamic banking software. Banks in the GCC are focusing on AI to boost efficiency and personalization. In an Islamic context, AI can power robo-advisors that create Sharia-compliant investment portfolios, or chatbots that explain halal financing options.

Machine learning helps with credit-scoring alternative segments (e.g. SMEs, freelancers) in line with Islamic ethics. Meanwhile, big data platforms allow analyzing large amounts of financial data to detect fraud or non-compliance (e.g. screening transactions against Shariah-violating criteria).

Skilled fintech teams often incorporate Python or TensorFlow libraries, but must ensure AI models are transparent and fair by Islamic standards.

5. RegTech and Compliance Tools

Regulatory technology automates compliance workflows. For Islamic finance software developers, RegTech means building in features like automated KYC/AML checks, continuous transaction monitoring, and audit logs specifically tuned to Islamic regulations.

For instance, UAE’s Amani AI (DIFC-licensed) offers AI-driven AML/CFT tools, while Saudi’s Moltazim provides a cloud-native platform that maps every business to relevant regulations. In practice, fintech platforms integrate APIs from identity verification (biometrics, document scanning) and smart alert systems.

Automated rule engines can flag any breach of Islamic guidelines or local laws, reducing manual audit overhead. Developers should adopt security best practices and encryption to protect data privacy, addressing the high emphasis on cybersecurity in finance.

Read: Retail Banking Software Development

Opportunities for Startups and Banks for Fintech Software Development

There are many niches for innovation in Islamic fintech:

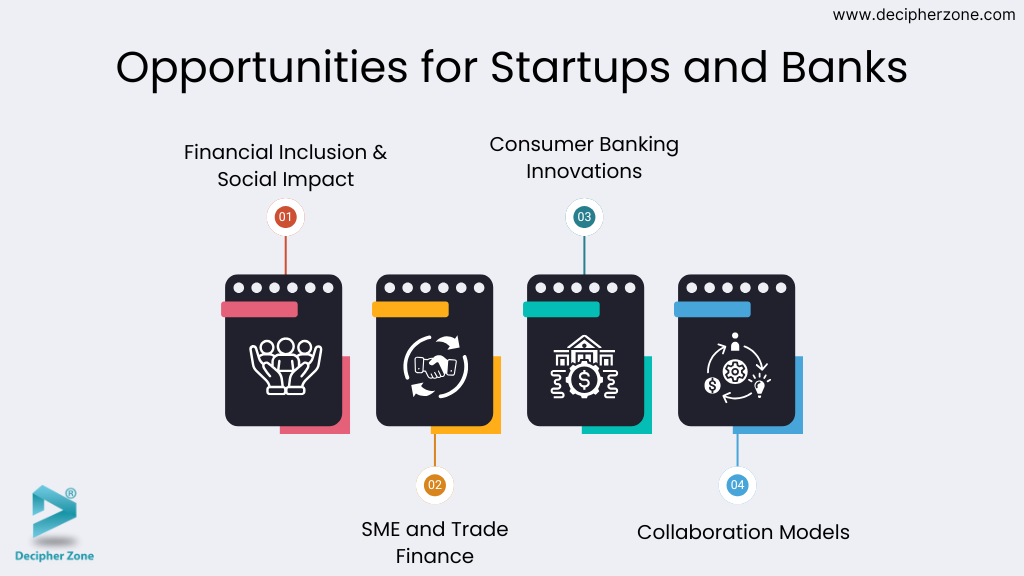

1. Financial Inclusion & Social Impact

Fintech can reach unbanked Muslim communities by offering low-cost mobile banking, micro-savings and micro-insurance (Takaful) through smartphone apps. Community-based models (like crowdfunding or mutual insurance) can provide interest-free finance while earning returns or social impact. For example, Islamic P2P lending platforms can finance small entrepreneurs via profit-sharing, unlocking new markets.

2. SME and Trade Finance

Small businesses often struggle to get Shariah-compliant loans. Digital trade finance platforms (like Ta3meed in Saudi) use automated screening and mobile applications to underwrite financing for halal business activities. Fintech software development in this space involves integrating real-time data (invoices, supply-chain info) to approve asset-backed loans quickly.

3. Consumer Banking Innovations

Modern Islamic banks are launching apps and digital-only offerings (e.g. Alinma in KSA, ila Bank in Bahrain). Dev teams can build features like halal investment robo-advisory, mobile sukuk purchase, or loyalty schemes offering hibah (Islamic “gifts”) instead of interest. BNPL services (Buy-Now-Pay-Later) are emerging too; companies like Tabby in UAE structure repayments as late-fee-free installments to avoid riba.

4. Collaboration Models

Established banks are actively partnering with fintechs. Many large Middle East banks (e.g. Al Rajhi, SNB in Saudi, Emirates NBD) now have innovation arms or investment funds. A development partner can work alongside a bank’s IT team, co-creating solutions (in a sandbox or via API integration). This ecosystem approach speeds innovation and provides fintechs with access to banking licenses and customers.

Challenges in Islamic Fintech Software Development

While the potential is vast, developers face specific hurdles:

-

Regulatory Complexity

-

Legacy Systems & Integration

-

Trust and Adoption

-

Talent and Resources

1. Regulatory Complexity

Islamic finance is overseen by both financial regulators and Shariah boards. Rules can vary significantly by country and even by individual banks’ interpretations. A solution acceptable in one jurisdiction may not be in another.

Software must therefore be highly configurable. For example, profit-sharing rates, eligibility criteria, or even what constitutes permissible investment can differ. Developers often build “regulatory engines” that allow local compliance teams to adjust rules without changing code.

2. Legacy Systems & Integration

Many Islamic banks still run on legacy core systems not designed for digital agility. Integrating modern fintech apps with these old systems (to update account balances, KYC info, etc.) is challenging.

Middleware and API layers are needed. Also, data migration from on-premise to cloud must be handled securely. In practice, this means using hybrid architectures and ensuring seamless data flow between new fintech modules and old banking infrastructure.

3. Trust and Adoption

Customers of Islamic banks are often conservative. They must trust that digital solutions truly follow Shariah. Any hint of non-compliance (like hidden fees) can erode credibility.

Fintech developers must design transparent user interfaces and clear documentation of Shariah adherence. Embedding audit trails and allowing customers to easily verify transactions against Shariah guidelines can build trust.

4. Talent and Resources

Building Shariah-compliant fintech requires expertise in both financial technology and Islamic law. Skilled developers who understand Islamic contracts are rare. Many fintech firms partner with Shariah consultants or hire Islamic finance specialists during development. Ongoing training and certifications (like IFSB standards) are common to ensure staff are up to date.

Read: Technologies Shaping The Future of Fintech

Case Studies and Real-World Examples of Fintech Software Development

-

Ta3meed (Saudi Arabia): A digital platform for Islamic trade finance that uses Mambu’s cloud banking system. It automates Purchase Order financing for SMEs, combining agile software with Shariah contracts. This partnership has streamlined funding for small businesses and aligns with Saudi Vision 2030’s SME growth goals.

-

UmrahCash (Saudi & Nigeria): A fintech app solving currency-access issues for African pilgrims. Instead of carrying cash or using the black market, pilgrims can load local mobile wallets via UmrahCash, which converts funds through permitted channels. This service leverages digital payments and mobile tech to serve religious needs while contributing to the goal of 70% non-cash transactions by 2030 in Saudi.

-

Takadao (US/MENA): A startup offering mutual insurance using blockchain. Community members pool funds and insure one another via smart contracts, fully Shariah-compliant (following AAOIFI standards). Their tech platform exemplifies how fintech can modernize traditional Islamic practices (Takaful) by using distributed ledgers to ensure transparency and trust.

These cases illustrate that digital transformation is already yielding practical Islamic finance solutions. Investors and developers can learn from these models: focus on clear customer benefits (easier Hajj spending, SME credit, inclusive insurance) and build robust backend systems that automate compliance.

Technology Stack and Best Practices for Fintech Software Development for Middle East Countries

When building Islamic banking software, consider these technical guidelines:

-

Modular Core Platforms

-

API-First Development

-

Cloud Security and Compliance

-

Agile and DevOps

-

User-Centric Design

1. Modular Core Platforms

Use composable banking platforms (Mambu, Tuum, or Temenos) that support Islamic products out of the box. These often expose RESTful APIs, configuration dashboards and templated workflows for Islamic accounts. Developers can avoid coding core finance logic from scratch by leveraging these services.

2. API-First Development

Follow an API-first approach. This means designing your software’s functionality as discrete services (KYC, payments, ledger, user profiles) with well-documented interfaces. This enables easy integration with third parties (fintech partners, regulators). It also makes future extensions (e.g., adding a new Islamic loan type) more straightforward.

3. Cloud Security and Compliance

Adopt cloud best practices (encryption, identity management, SIEM). For Middle East deployments, ensure data residency compliance (some countries require data to stay in-country). Use cloud regions or private cloud as needed. Rigorous data encryption and role-based access are essential to meet both global and local privacy regulations.

4. Agile and DevOps

Islamic finance demands frequent updates (e.g. new Shariah rulings, regulation changes). An Agile development methodology with continuous integration/continuous deployment (CI/CD) pipelines allows the software to evolve. Maintain a close feedback loop with Shariah and regulatory teams to incorporate rule changes rapidly.

5. User-Centric Design

Since user expectations for digital banking are high, invest in a clean, intuitive UI/UX. Mobile-first design is crucial given the region’s high smartphone penetration. Provide in-app education (e.g. infographics explaining how a loan structure complies with Shariah) to build trust. Multilingual support (Arabic/English) is often required.

Read: Trends, Methodologies, and Outsourcing Strategies

Call to Action

Fintech startups and Islamic banks looking to innovate should partner with experienced development teams who understand both technology and Shariah principles. By combining agile software practices with Islamic finance expertise, your organization can launch compliant fintech solutions faster.

Whether you need a cloud-native core banking platform, a secure mobile app for Zakat collection, or an automated RegTech system, our experts can guide the way. Contact us today to discuss your Islamic fintech project – schedule a demo or consultation and accelerate your digital transformation in Islamic finance.

FAQs

What is Shariah-compliant fintech software?

It’s financial software designed to follow Islamic laws—avoiding interest and forbidden industries—using contracts like Murabaha and Mudarabah for ethical banking.

How does open banking help Islamic finance?

It allows secure data sharing via APIs, helping Islamic banks offer personalized, Shariah-compliant services like automated Zakat and halal investment tools.

What challenges do Islamic banks face in fintech?

Major hurdles include complex regulations, outdated systems, and the need to ensure every feature aligns with Shariah and earns customer trust.

What are some Islamic fintech innovations?

Examples include Ta3meed for SME financing, UmrahCash for pilgrim payments, and Takadao for blockchain-based mutual insurance (Takaful).

Which technologies drive Islamic fintech?

Key tech includes cloud-native banking, open APIs, blockchain, AI, and RegTech—ensuring compliance, scalability, and better user experiences.

**Disclaimer: Some images used in this article have been generated with the assistance of AI.