Online Payment App Development - Everything You Should Know. Technology is taking over every industry and has made businesses more accessible to customers with the advent of software development, which has also led to the advent of online payment app development. It not only makes the checkout process hassle-free but also helps in tracking and managing the payments with ease.

According to reports from a trusted source, the online payments industry is expected to grow to a CAGR of 26.93% from 2020 to 2025, clearly showing signs of impeccable growth, thus making it an important reason to consider online payment app development for your business, and if you are interested in developing one such web application for your business, then this blog is for you.

Read: Payment Gateway Development - Benefits and Tips to Consider

Here, we will be filling you up with what is an online payment app along with its types, pros and cons, essential features, and cost of development.

So, without any further ado, let’s get started!

Online Payment App Development

Online payment app development refers to the process of designing and developing mobile apps that facilitate financial transactions over the Internet. These apps allow users to make online payments anytime and anywhere, alongside several other functionalities.

Read: Financial Services Software Solutions

Google Pay, PayPal, Apple Pay, Stripe, Cash App, Paytm, PhonePe, and Freecharge are some of the well-known online payment apps, that are widely being used in the market, making transactions seamless.

Read: Top FinTech Industry Trends for 2023

Types of Online Payment App Development

There are different types of online payment applications available in the market, and when considering developing a payment app, some of the few types that you can choose from for your business are -

-

Retail Payment Apps

-

Peer-to-Peer (P2P) Payment Apps

-

Banking and Financial Apps

-

Bill Payment Apps

-

International Money Transfer App Development

-

Cryptocurrency Payment Apps, and

-

Contactless/NFC Payment Apps.

Read: Most Popular Types of Software Development

Although these apps fall under the same category, each of these types of applications has unique features and benefits to cater to different business requirements.

Also take note that, you can also consider custom mobile app development if you want to integrate features that serve your specific business requirements.

Read: Fintech App Development - Types, Features, and Cost

Pros and Cons of Online Payment App Development

Online payment app development has streamlined the way users make and accept payments alongside several other benefits to the business and its customers.

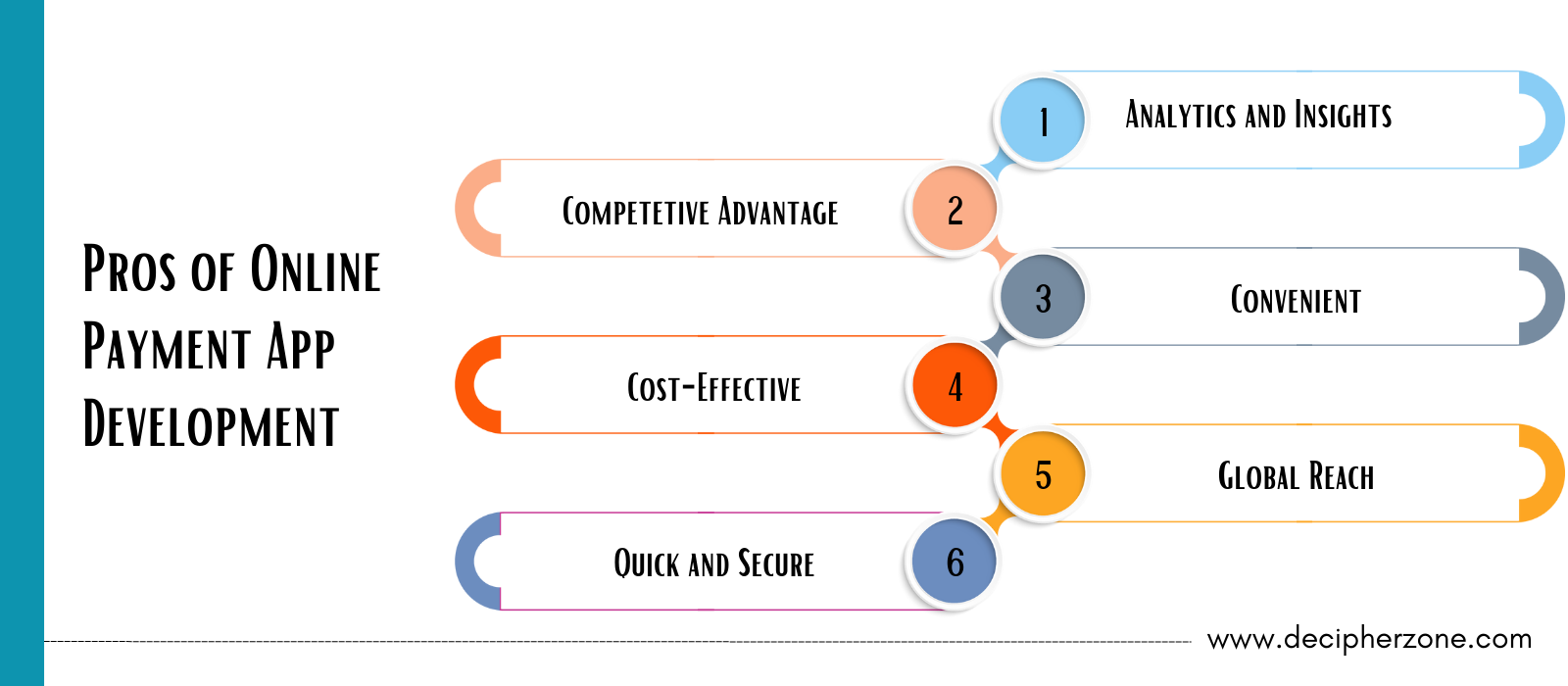

Some of the pros of online payment app development are as follows -

-

Analytics and Insights

-

Competetive Advantage

-

Convenient

-

Cost-Effective

-

Global Reach

-

Quick and Secure

Analytics and Insights

The first and foremost advantage of online payment app development is that it provides you with detailed analytics and insights based on several business parameters and other metrics alongside user behavior and usage patterns, which helps you understand your business functions better and strategize new growth plans accordingly.

Read: The Future of Payment Gateways - Challenges and Trends

Competitive Advantage

Developing an online payment application also helps you gain a competitive edge in the market by allowing you to integrate features that make your business services unique and stand out in the market.

Convenient

Another reason why you should consider developing an online payment app for your business is that it makes it convenient for the users, by enabling them to make payments anytime and anywhere without having to worry about carrying physical cash, thus also eliminating the risk of theft or loss of cash.

Read: Cash Management System Development: Benefits & Cost

Cost-Effective

It also helps in making your business cost-effective by eliminating all the related paperwork and reducing the manual labor which in turn also eliminates the possible manual errors, alongside reducing the operational costs, thus increasing the profits and accelerating business growth.

Global Reach

Online payment app development also enables your business to operate globally, thus widening the target market, without having to be physically present in all the locations. It also helps you increase your user base and generate more revenue from it.

Read: Global Business Management Software Development

Quick and Secure

Furthermore, developing an online payment app also makes your business services quick and secure as it streamlines the process with automation, which in turn speeds up the payment sending and receiving process alongside ensuring security with the integration of several security protocols and authentication methods. It also helps in preventing the risk of money theft, fraud, and other related cyberattacks, keeping your data safe and secure.

Read: What is Cybersecurity? Everything You Need to Know

Apart from the benefits, you should also know about the drawbacks and challenges that you might encounter during the development process. Learning about the drawbacks will not only help you devise a business plan strategically but will also help you make your mobile app adaptable to the changing market trends and eliminate the potential drawbacks.

Some of the most common drawbacks of online payment app development are as follows -

-

Market Competition

-

Regulatory Compliance

-

Scalability Issues

-

Technical Challenges

-

User Trust and Adoption

Read: Software Development Challenges and Solutions

1. Market Competition

With the online payment market growing rapidly, developing one such application can be highly competitive, which implies that competing with well-known brands like PayPal, Paytm, and others can be quite difficult, which is an important drawback to consider. So, when developing an online payment app, make sure that you do thorough market research and conduct a SWOT analysis to stand out in the marketplace.

Read: Difference Between Web Payment Service and Payment API

2. Regulatory Compliance

Online payment app development also requires obtaining the necessary licenses and documentation for different locations and regions, which makes it a time-consuming process, thus affecting the delivery of the application.

3. Scalability Issues

When developing an online payment application, make sure that the app can handle and accommodate the increasing number of transactions according to the growing use base and ensure seamless performance, which can eliminate possible scalability issues.

4. Technical Challenges

Another potential drawback of online payment app development is that you can also come across several technical challenges that might require specific expertise and experience, thus consuming a lot of time, effort, and money alongside affecting the overall performance of the application.

So, when choosing the tech stack make sure that you choose such a technology that perfectly suits all your project requirements, thus enabling you to develop a future-proof solution for your business.

Read: Top 5 Payment Gateways for your Web Application

5. User Trust and Adoption

Gaining user's trust is an important part of the success of a business, and can be a challenging process, especially when there are established industry giants in the market.

Now that you know about online payment app development, and its pros and cons, let us also fill you up with some of the important features to integrate in an online payment application.

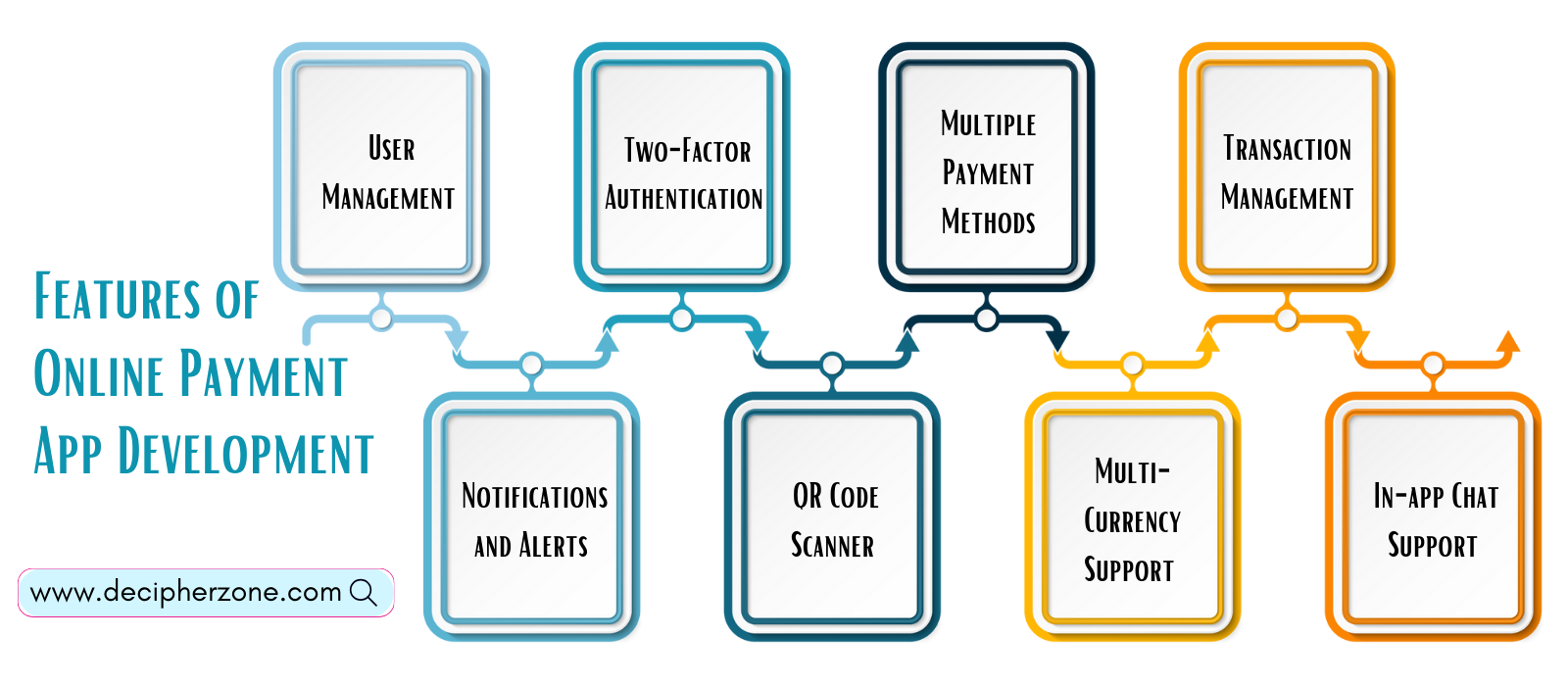

Features to Integrate in an Online Payment App Development

Some of the common features that you should integrate into the online payment app development include the following -

-

User Management

-

Two-Factor Authentication

-

Multiple Payment Methods

-

Transaction Management

-

Notifications and Alerts

-

QR Code Scanner

-

Multi-Currency Support

-

In-app Chat Support

User Management - Create, Edit, and Delete a user account along with viewing and updating the necessary details, whenever needed.

Two-Factor Authentication - This feature ensures the security of the app and the user data and allows to verify the user via mobile number verification, OTP, email verification, or other authentication apps.

Multiple Payment Methods - This feature helps in providing various payment methods like Net Banking, Credit/Debit cards, Mobile Wallet Integration, Cryptocurrency support, and many more.

Transaction Management - Integrating this feature into an online payment app development helps in monitoring and managing all the transactions alongside allowing you to view the payment history based on several filters, thus making it easier for the users to get every detail on a particular transaction they made.

Notifications and Alerts - It is one of the most common and important features to integrate into an online payment app development and is also a great marketing tool for a business. It helps the users get alerts about upcoming payments or payment reminders like notifications about credit card bills, housing rent, and many more, alongside sending alerts in case of suspicious activity.

QR Code Scanner - It is the most important feature of an online payments application, that helps the users scan a QR and make transactions easier and hassle-free, eliminating the need to enter the receiver's bank account details manually.

Multi-Currency Support - If you want to make your business a global brand, make sure that you integrate the multi-currency feature, which allows users to convert currencies without having to visit any currency exchange center, thus speeding up the transaction process.

In-app Chat Support - This feature helps the users to avail of customer support services anytime and anywhere in case they get stuck while making a payment. It also helps you gain trust and credibility with your customers helping in a higher user engagement rate.

Features are an integral part of an application or software and with competition in every business sector, not only it is important to switch to software development or mobile app development, but integrating unique features into the solution is equally important.

Read: Common Features of Mobile Apps and their Benefits

Now that you have reached here, one question that might have been on your mind continuously, while reading the blog is the cost of online payment app development. So, below we have listed a few factors that majorly impact the development costs.

Read: Loan Lending App Development Cost, Features and Steps

Cost of Online Payment App Development

The cost of online payment app development can start from as low as $25,000 and can rise to $3,00,000 and even more based on several factors. Some of the most important factors that should be considered while estimating the cost of online payment app development are as follows -

-

The type of app that you want to develop i.e. Native App Development, Hybrid App Development, or Cross-Platform App Development.

-

The platforms for which you want the online payments app, for example, whether you want an Android app, iOS app development, or both.

-

The domain and hosting charges along with the logo design and branding.

-

The technology stack that you choose alongwith the development approach, model, programming languages, frameworks, plugins, and other tools and libraries.

-

The experience and expertise of the app development team, as well as the location and hourly charges of the development company also add up to the cost of online payment app development.

-

The UI/UX design of the applications with the total number of screens alongside the integration of high-quality visuals and animations might also affect the cost of development.

-

The total number of features along with the complexity of integrating them into your application.

-

The third-party API integration and licensing costs alongwith integrating additional security protocols also influence the cost of development.

-

Platform fee is another important factor that should be considered when launching an app on the Apple store, as they charge a one-time fee,

-

Different levels of app testing and post-launch maintenance and support and the content and marketing charges should also be considered when calculating the cost.

Read: How Much Does It Cost to Develop a Web Application in 2023

Wrapping It Up

With technology simplifying every aspect of a business and every industry, online payments app development is the masterstroke to make. With a wide range of advantages, it not only helps in simplifying the transactions but also helps you access your payment history and track them whenever needed.

Read: What is Custom Software Development?

So, if you are thinking about developing an online payments app, then now is the time to start working on it!

Connect with us, or hire a developer, and Decipher Zone will help you develop the best online payments application for your business that is easy to use, seamless, and secure at competitive rates.

FAQs about Online Payment App Development

How much time does it take to develop an online payment application?

Online payment app development can take up to 20 - 24 weeks and sometimes even more, depending on factors like the changing market trends and project requirements, the total number of resources working on your project, the budget, and many more.

What are the different ways to monetize an online payment app?

The different ways to monetize an online payment app include Transaction fees or convenience fees, Subscription plans, Merchant services, In-app advertising, Foreign exchange fees, Data monetization, and many more.

How can I ensure safety to prevent fraud in an online payment app?

Some of the ways to ensure security and prevent fraud in an online payment are robust encryption, authentication protocols, real-time transaction monitoring, AI-based fraud detection, compliance with security standards, and many more.