Quick Summary: Investment and portfolio management software development is transforming how wealth is managed in the digital era. This comprehensive guide explains what these software platforms are and why they’re crucial in 2025 and beyond. We delve into core features (from portfolio analytics and risk management to robo-advisory and compliance tools) and real-world benefits such as improved efficiency, user empowerment, and enhanced transparency.

You’ll also discover emerging trends (like AI, personalization, and open banking) shaping the future of investment management, and learn how Decipher Zone’s expert approach to software development can help build robust, scalable investment platforms aligned with global financial trends.

A Comprehensive Guide to Investment Portfolio Management Software Development in 2025

What is Investment and Portfolio Management Software?

Investment and portfolio management software refers to digital platforms and applications that help manage financial investments and asset portfolios. In simple terms, it’s the technology that powers how investors, advisors, and institutions track and grow wealth.

These solutions can range from robo-advisors (automated platforms that invest on behalf of individuals) to sophisticated portfolio management systems used by financial advisors, wealth management firms, hedge funds, and banks.

They often encompass tools for analyzing investment portfolios, executing trades, monitoring performance, and ensuring compliance with financial regulations.

At its core, this software provides a centralized hub to handle everything related to investments: portfolio tracking, asset allocation, trade execution, risk analysis, and reporting.

For example, an individual investor might use a mobile app to see their stock and bond holdings in real time, while a financial advisor at a firm might use an enterprise portfolio platform to rebalance hundreds of client portfolios with a few clicks.

In both cases, the software acts as the digital backbone that records transactions, calculates portfolio values, and presents insights through dashboards and reports.

Crucially, modern investment management platforms are designed to be user-friendly and secure. They often integrate with brokerage accounts, banks, and market data feeds to provide up-to-the-minute information.

They also enforce compliance (for instance, logging all trades and generating audit trails required by regulators) and maintain strict security for sensitive financial data.

In short, investment and portfolio management software is the engine that enables investors and financial professionals to make informed decisions, automate routine tasks, and manage assets efficiently in today’s fast-paced financial markets.

Top 5 Reasons to Invest in Investment Management Software Development in 2025

Here are five key reasons why investing in modern investment and portfolio management software development is a top priority now and for the future:

-

Digital-First Investors and Clients

-

Competitive Pressure from Fintechs and Robo-Advisors

-

Post-Pandemic Digital Acceleration

-

Regulatory Compliance and Security Demands

-

Personalization and Enhanced Client Experience

1. Digital-First Investors and Clients

Today’s investors – from millennials to institutional clients – are digital-first in their expectations. Just as consumers embraced online banking, they now expect the same on-demand convenience for managing investments.

Globally, we see a broader shift where digital channels are dominating financial services. In fact, studies estimate that by 2025 over 90% of banking interactions will occur through digital channels.

This digital preference extends to wealth management: investors want to check their portfolios on mobile apps, receive real-time updates, and execute trades anytime, anywhere.

If you’re managing money, offering a seamless digital experience is no longer optional – it’s expected. Failing to provide robust digital investment tools risks losing clients who demand the flexibility and immediacy that only software can deliver.

2. Competitive Pressure from Fintechs and Robo-Advisors

The financial industry is facing intense competitive pressure from fintech startups and robo-advisors. Innovative platforms like robo-advisory services have made automated, low-cost investment management widely available.

These fintech solutions often attract customers with slick user experiences and AI-driven insights. As a result, traditional financial institutions – banks, brokerages, wealth management firms – must up their software game to stay relevant.

They are increasingly investing in their own investment management software development or partnering with tech firms to offer comparable digital services.

We’ve witnessed incumbents making strategic moves to counter fintech challengers. For example, large banks have acquired online brokers or launched their own robo-advisor platforms to expand their digital offerings.

This is because automation and smart algorithms allow newer entrants to manage thousands of clients’ portfolios with minimal human intervention, often at lower fees. To compete, established firms need software that can similarly automate portfolio rebalancing, provide intelligent recommendations, and scale to a large number of users efficiently.

Even traditional banks recognize they can’t go it alone. According to industry surveys, about 82% of incumbent banks plan to increase partnerships with fintech companies in the next few years. This collaboration often involves co-developing or integrating software solutions to enhance investment services.

In the wealth management sector, this could mean integrating a fintech’s robo-advisor engine into a bank’s platform or using an API from a fintech to offer new asset classes (like cryptocurrencies or peer-to-peer lending products).

3. Post-Pandemic Digital Acceleration

The COVID-19 pandemic accelerated digital transformation across all financial services, including investment management. When in-person meetings and paper processes became impractical, even the most traditional wealth managers had to adopt digital tools nearly overnight.

This period highlighted the importance of having robust portfolio management software to ensure business continuity. Advisors began using cloud-based platforms to review portfolios with clients over video calls, and individual investors flocked to digital trading apps during market volatility.

This shift is not reversing. Post-pandemic, firms continue to prioritize digital channels and remote-friendly technology. Internal processes like client onboarding, risk profiling, and financial planning have been digitized via secure portals and apps. Clients, now accustomed to these conveniences, are unlikely to accept a backward step.

As a result, developing custom investment management software that supports remote access, digital document handling, e-signatures, and online collaboration is critical. It allows financial institutions and fintech startups to operate resiliently under any circumstances – be it global disruptions or simply serving clients who prefer digital interaction.

4. Regulatory Compliance and Security Demands

Regulatory compliance and data security are front-of-mind in the investment industry – and modern software is key to excelling in both areas. Financial services are heavily regulated to protect investors and maintain market integrity. Whether it’s the EU’s MiFID II rules, the SEC’s regulations in the US, or data protection laws, compliance requires detailed record-keeping, transparency in fee reporting, and stringent client data protection.

Manually satisfying these requirements is labor-intensive and error-prone. Investment management software can automate compliance checks (for example, flagging a trade that would violate a client’s risk profile or a conflict of interest) and generate the reports regulators need.

Moreover, robust software ensures security through features like encryption, multi-factor authentication, and access controls. Given that 61% of financial services CEOs cite cyber threats as a top concern, any platform dealing with sensitive financial data must be secure by design. A breach or data loss can be catastrophic in terms of both regulatory penalties and reputational damage.

By developing a custom solution, companies can bake in security from the ground up – using secure coding practices, rigorous testing, and compliance with standards like SOC 2 or ISO 27001. Modern portfolio platforms also often include audit logs and analytics that can help detect fraud or unusual activities in real time.

Regtech (regulatory technology) has become part of investment software. This includes modules for identity verification (KYC/AML checks during investor onboarding), transaction monitoring, and producing audit trails automatically. By leveraging these capabilities, financial institutions not only avoid compliance pitfalls but also build trust with clients through transparency.

5. Personalization and Enhanced Client Experience

Today’s investors expect a highly personalized and engaging client experience, and software is the enabler of that. Just as streaming services personalize recommendations, investment platforms can tailor portfolios and advice to individual preferences.

Advanced investment management software leverages data and analytics to deliver insights unique to each user – whether it’s personalized asset allocation based on one’s risk tolerance, or contextual alerts and content (e.g., “Your portfolio’s carbon footprint is higher than 80% of peers, consider these ESG funds”). This level of personalization is increasingly a differentiator.

A better client experience leads to higher satisfaction and retention, which is why wealth managers are embracing technology that helps them deliver customized advice at scale.

Analytics and AI play a big role here. Machine learning algorithms can analyze market data and client behavior to suggest investment opportunities or portfolio adjustments. For example, the software might identify that a client’s portfolio is too concentrated in tech stocks and recommend diversification, or it may use robo-advisor techniques to periodically rebalance a portfolio to keep it aligned with the client’s goals.

Not only does this provide a more tailored service, it also educates and empowers clients, making them feel more involved in the process. Surveys indicate that a large portion of investors, including high-net-worth individuals, now prioritize a strong digital experience in wealth management – often as much as the personal relationship with their advisor. In one survey, 76% of online banking users expressed satisfaction with their digital experience, and similar trends are seen in investment services.

Features like client portals, mobile apps, and even gamified investing experiences (such as progress trackers, rewards for meeting goals, etc.) can significantly enhance engagement.

Personalization at scale is only achievable through sophisticated software development. This is why firms are investing in portfolio management software that not only crunches numbers but also delivers a superior user experience tailored to each client’s journey.

Read: Tools and Platforms for Efficient Software Development

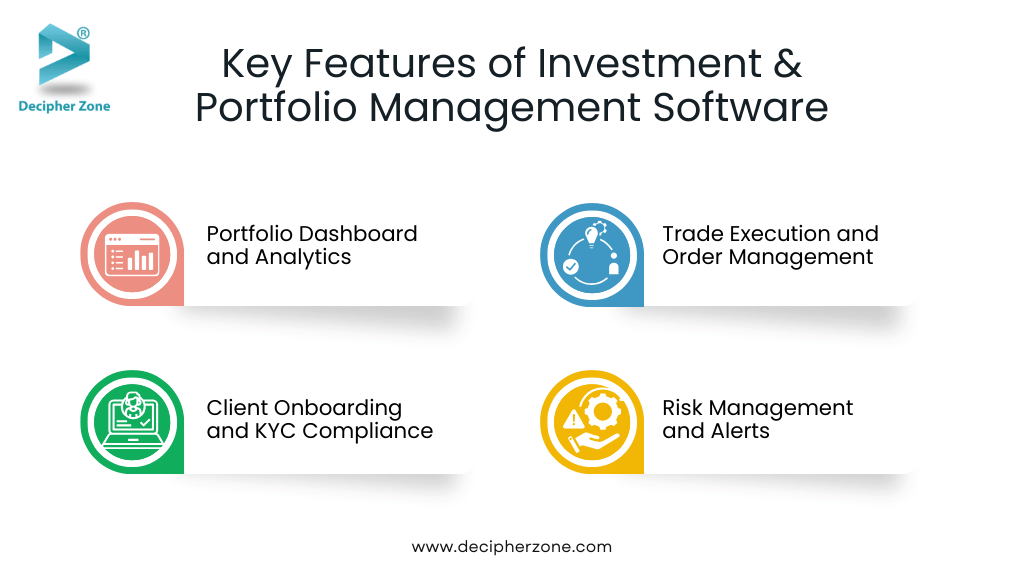

Top Key Features to Consider in an Investment & Portfolio Management Software Development in 2025

Below are some of the core features and capabilities that such software typically includes:

-

Portfolio Dashboard and Analytics

-

Trade Execution and Order Management

-

Client Onboarding and KYC Compliance

-

Risk Management and Alerts

-

Performance Reporting and Statements

-

Collaboration and Client Portal

-

Integration with External Data and Systems

-

Advanced Tools

Building effective investment management software requires incorporating a range of powerful features.

1. Portfolio Dashboard and Analytics

At the heart of any portfolio management system is a comprehensive dashboard that gives an overview of investments. This includes real-time portfolio valuation, asset allocation breakdown (e.g., how much in stocks, bonds, cash, etc.), and performance metrics.

Advanced analytics tools allow users to drill down into individual assets, view profit/loss, analyze returns over various time frames, and compare performance against benchmarks or indices.

For professional platforms, analytics might also include metrics like alpha, beta, Sharpe ratio, and VaR (Value at Risk) to assess investment risk and performance. These insights empower users and advisors to make data-driven decisions on rebalancing or strategy changes.

2. Trade Execution and Order Management

Good investment software often integrates trading functionality or connects seamlessly to brokerage systems. This means users (or advisors on behalf of clients) can execute trades (buying or selling stocks, bonds, funds, etc.) directly through the platform. Order management features handle the routing of orders to exchanges or brokers and track the status of each trade.

For institutional use, the software might include advanced order types, trade allocation for multiple client accounts, and compliance checks before execution. Having trading integrated saves time and reduces errors, as users don’t need to switch to another interface – everything from analysis to execution happens in one place.

3. Client Onboarding and KYC Compliance

Particularly for platforms used by financial advisors or fintech services, client onboarding modules are key. Software can streamline the Know Your Customer (KYC) process and account setup by providing digital forms, document upload capabilities, and even e-signatures for agreements.

Read: Investor Relationship Management Software

This not only improves user experience (no more paper forms) but also ensures all required data is captured and verified. Automated workflows can run identity checks and AML (anti-money laundering) screenings. By integrating compliance into the onboarding, the software helps companies adhere to regulations from the very start of the client relationship.

4. Risk Management and Alerts

Managing risk is crucial in investing, and the software can assist by continuously monitoring portfolios against risk parameters. For example, the system can flag if a portfolio becomes too concentrated in one sector or if it’s drifted from the client’s risk profile. It can also stress-test portfolios under various market scenarios (like interest rate spikes or market crashes) to predict potential losses.

Alerts and notifications are another key feature – both for opportunities and risks. Users might get an alert if their portfolio hits a new high, if a significant market event occurs, or if their holdings drop below a certain threshold.

Advisors can set custom alerts for client portfolios (e.g., notify if cash allocation is above 10% so they can consider investing idle cash). Such proactive risk management features ensure that investors can respond quickly to market changes and remain aligned with their goals.

Want these features in your own investment platform?

Let our experts help you design and build a tailored solution that scales.

📞 Contact Decipher Zone for a personalized roadmap.

5. Performance Reporting and Statements

Investment management platforms typically provide robust reporting tools. Users and clients expect clear, detailed reports showing portfolio performance, fees, transactions, and holdings.

Customizable report generation allows advisors to produce quarterly or monthly investment statements for clients with the company’s branding, or individuals to generate their own reports for personal tracking.

Modern software can generate on-demand reports as well as scheduled summaries, often with interactive elements (like charts and graphs) to visualize performance. This enhances transparency, as clients can clearly see how their money is invested and how it’s performing over time.

6. Collaboration and Client Portal

For software used by advisory firms, a client portal is a vital feature. It serves as a secure area where clients can log in to view their portfolio, upload or download documents, communicate with their advisor, and even tweak their investment preferences.

.avif)

Advisors, on the other side, have a relationship management interface to keep track of client communications, notes from meetings, and financial plans. This two-way collaboration through the software improves the advisor-client relationship.

Instead of back-and-forth emails or calls for every statement or document, the portal centralizes everything. Some platforms include secure messaging or chat features, so clients can ask questions and advisors can respond in-app. Essentially, the software can double as a lightweight CRM (Customer Relationship Management) system tailored for investment management, keeping client interactions and data in one place.

7. Integration with External Data and Systems

Investment software rarely operates in isolation. It needs to integrate with various external data sources and services. For instance, real-time market data feeds (for stock prices, news, etc.) are integrated so that the information displayed is current. Many platforms also connect with third-party financial data providers for things like fund information, ESG ratings, or economic indicators.

Through APIs (Application Programming Interfaces), a robust platform can pull in data from a user’s other financial accounts (enabling an aggregated view of their finances) – this is part of the growing open banking/open finance trend.

According to Accenture, over half of global banks had embraced open banking by 2022, which paves the way for investment apps to securely connect and aggregate data across institutions. For a custom-developed software solution, planning for integrations from the start is important, as it greatly extends the platform’s functionality and convenience.

8. Advanced Tools

Investment management software is incorporating advanced tools like AI-driven robo-advisory features, chatbots, and even blockchain capabilities. An AI-driven recommendation engine can analyze a client’s goals and market conditions to suggest optimal investment plans (much like how robo-advisors operate).

Ready to build a powerful investment management platform?

Partner with Decipher Zone to turn your vision into a scalable, secure, and future-ready solution.

👉 Get in Touch Today

Machine learning can also help in fraud detection or in predicting client churn (e.g., identifying clients who might leave and prompting proactive engagement). Some platforms are exploring blockchain for improved transparency and efficiency – for instance, using distributed ledger tech to record ownership of alternative assets or to enable trading of tokenized assets 24/7.

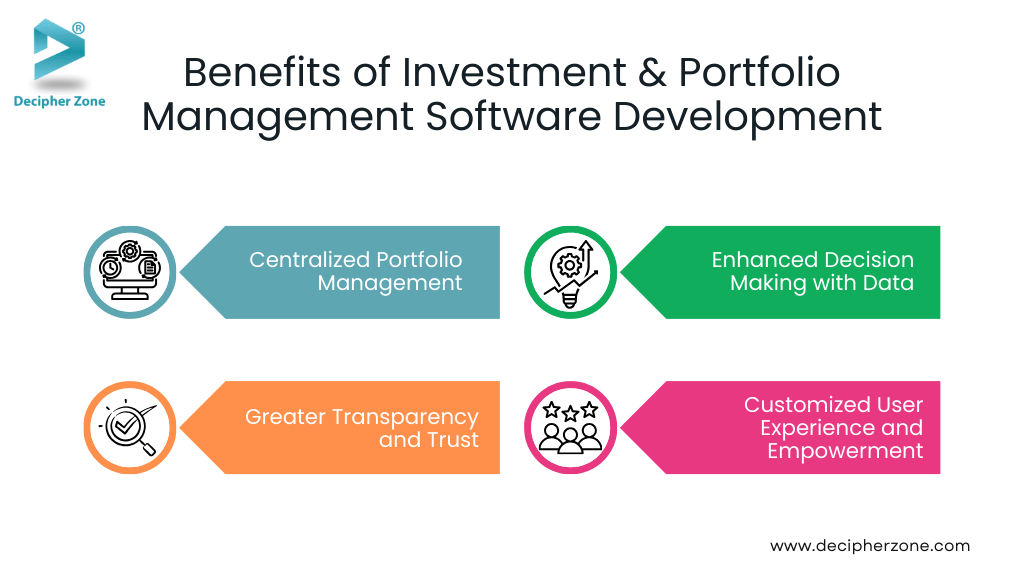

7 Benefits of Investment & Portfolio Management Software Development

Here are some of the standout benefits and how the software tangibly empowers users:

-

Centralized Portfolio Management

-

Enhanced Decision Making with Data

-

Greater Transparency and Trust

-

Customized User Experience and Empowerment

-

Cost Reduction and Increased ROI

-

Competitive Advantage

-

Alignment with Modern Trends

Implementing a robust investment management software solution offers numerous benefits for all stakeholders – financial firms, advisors, and individual investors alike.

1. Centralized Portfolio Management

By automating routine tasks (like portfolio rebalancing, report generation, or trade execution), the software dramatically improves operational efficiency. Advisors who might have been able to manually handle 50 clients can now effectively manage hundreds, as the system takes care of many calculations and workflows.

This scalability means firms can grow their business without a linear increase in headcount or costs. For individual investors, efficiency means they can manage their own portfolio without needing an advanced degree or an army of analysts – the software does the heavy lifting (e.g., crunching performance numbers or flagging portfolio issues) in seconds.

Read: Retail Banking Software Development

2. Enhanced Decision Making with Data

Good software provides a wealth of data and analytical tools at one’s fingertips. Investors and portfolio managers can make better-informed decisions because they have up-to-date information and insights (such as risk metrics and forecast simulations).

For instance, before making an investment, a user can analyze how adding that asset might affect their overall portfolio risk/return. Advisors can use scenario analysis tools to show clients the potential outcomes of different strategies.

This data-driven approach often leads to better investment outcomes and helps remove emotion or guesswork from decision-making. It’s no surprise that firms that leverage advanced analytics have seen improved performance; they can identify trends and opportunities that might be missed with manual analysis.

3. Greater Transparency and Trust

Transparency is a crucial benefit, especially in an era where trust in financial services is built on openness and honesty. Investment management platforms give clients 24/7 visibility into their holdings and performance. Instead of opaque quarterly statements, clients can log in anytime to see exactly how their portfolio is doing and what fees they are paying.

This transparency not only keeps clients informed but also holds advisors and managers accountable in real time. If something isn’t performing well, both the client and manager see it immediately and can discuss corrective action. In the long run, this openness nurtures trust – clients feel in control and in the know.

4. Customized User Experience and Empowerment

As discussed earlier, personalization is a key trend and benefit. The software can adapt to user preferences, making the experience more relevant and empowering.

For example, an individual investor can set their app to “dark mode” if they do a lot of evening trading, or customize their dashboard to show the metrics they care about most (such as dividend income or ESG score). Advisors can tailor their interface to their workflow, perhaps having a dashboard of alerts for their top clients.

Read: Fintech Software Development Guide

This flexibility leads to users feeling a greater sense of control and empowerment over the investment process. An empowered user is likely to be more engaged and proactive, potentially leading to better investment habits (such as regular portfolio reviews, staying informed on financial news, etc.)

5. Cost Reduction and Increased ROI

Over time, investment in a quality software platform can reduce operational costs and increase profitability. Automation reduces manual errors (which can be costly) and lowers the amount of labor needed for tasks like reconciliation, compliance checks, or client reporting.

Additionally, a well-designed platform can attract more clients or assets – for instance, a fintech app with a smooth user experience might rapidly grow its user base with relatively low customer acquisition cost due to word-of-mouth and virality. For established firms, offering a slick digital platform can be the difference in winning business from a new generation of clients.

.avif)

6. Competitive Advantage

Deploying a tailored investment management platform can give firms a technological edge. Capabilities like algorithmic trading, robo-advisory services, or AI-driven insights can set a company apart from competitors.

In the fast-evolving fintech space, having proprietary tools that adapt to market trends (like supporting cryptocurrency assets or ESG ratings) helps attract tech-savvy clients. Early adopters of advanced investment software often capture market share by offering services that traditional firms cannot.

7. Alignment with Modern Trends

Finally, deploying investment management software ensures that a company stays aligned with how the industry and client expectations are evolving. For example, consider the growing interest in sustainable investing – a modern platform can integrate ESG (Environmental, Social, Governance) data, allowing users to filter or assess their portfolios based on sustainability criteria. This would position the firm to attract clients who prioritize ESG factors.

Similarly, as new asset classes (like cryptocurrencies or tokenized assets) become more mainstream, software can be updated to support them, keeping users at the forefront of investment opportunities.

Read: The Future of Banking

6 Trends Shaping Investment and Portfolio Management Software in 2025

Several key trends are shaping how new software platforms are being developed and what capabilities they offer. Being aware of these trends is important for anyone looking to develop or adopt an investment management solution:

-

Artificial Intelligence and Machine Learning

-

Mobile-First and Omni-Channel Experiences

-

Open Finance and API Ecosystems

-

Inclusion of Alternative Investments and Asset Classes

-

Focus on UX Design and User Education

-

Sustainability and ESG Integration

The landscape of investment management technology is continually evolving.

1. Artificial Intelligence and Machine Learning

AI is increasingly embedded in financial software. From robo-advisors that automatically adjust portfolios using algorithms, to AI-driven analytics that can predict market scenarios or suggest optimal investment strategies, this technology is a game-changer.

As mentioned, a large majority of financial institutions have been integrating AI – around 77% were expected to do so by 2022 – which means by 2025 we are seeing its fruits.

Expect more intelligent virtual advisors, predictive analytics for market trends, and AI tools that help advisors personalize advice (for example, by analyzing a client’s life events or spending patterns to recommend investments).

2. Mobile-First and Omni-Channel Experiences

The dominance of smartphones means any new investment software must prioritize mobile user experience. Many investors primarily use mobile apps to check their portfolios or even execute trades. Thus, developers are focusing on mobile-first design, ensuring that all functionalities (analytics, trading, research, communication) are accessible and user-friendly on a small screen.

At the same time, an omni-channel approach is key – users expect a seamless experience whether they’re on their phone, tablet, or desktop, or switching between them. Data should sync in real time across devices, and the interface should be consistent.

This trend forces development teams to use responsive design and often build cross-platform applications (for instance, using Progressive Web App technology or native apps for each platform) so that the service is available whenever and however the user chooses.

3. Open Finance and API Ecosystems

Building on the open banking movement, open finance is gaining momentum. This is the idea of using APIs to allow secure sharing of financial data and services between institutions. For investment software, this means the ability to pull in a user’s accounts from various brokerages or banks into one unified view, or to plug the software’s capabilities into other platforms.

For example, a fintech might offer its trading platform as a service that other banks can embed in their apps via an API. Development is increasingly focused on interoperability – ensuring your portfolio management system can talk to other systems.

This trend also includes integration with popular financial planning tools, accounting software, or even personal finance apps, creating a richer ecosystem. The result is greater convenience for users (all financial info in one place) and new partnership opportunities for companies.

4. Inclusion of Alternative Investments and Asset Classes

The range of investments people want to manage digitally has expanded. Beyond stocks and bonds, there’s growing interest in alternative assets like real estate crowdfunding, commodities, private equity, and cryptocurrencies. Modern portfolio software is trending towards including these assets in their platform.

For instance, some robo-advisors now offer allocations to crypto assets; some wealth management platforms include tools for managing stock options or private placements for accredited investors. Incorporating diverse asset classes poses challenges (e.g., getting pricing data for illiquid assets, or securely connecting to crypto exchanges), but it’s a trend that aligns with investors seeking diversification.

Platforms that allow a holistic view of all assets – traditional and alternative – provide more value. As a result, developers are building more modular systems where new asset modules can be added as needed, and ensuring strong integration with external systems that handle these asset types.

.avif)

5. Focus on UX Design and User Education

A subtler but important trend is the intense focus on user experience (UX) and education within the software. Given the complexity of investing, platforms are trying to simplify interfaces and also educate users as they go. This includes clean, intuitive design (so that even complex analytics are presented in an understandable way) and embedded educational content.

For example, hovering over a metric might show a tooltip explaining “What is ROI?” or the app might have a guided tour that helps a new user build their first portfolio step-by-step. Some platforms incorporate gamification elements – turning the achievement of investment goals into a game-like experience with progress bars or badges, which can increase engagement.

The trend recognizes that software isn’t just about raw functionality; it’s also about making the user feel comfortable and informed. A conversational tone in explaining features, AI-driven FAQs or chatbots to answer questions, and scenario simulators (where users can play “what-if” with their portfolio) are all features stemming from this emphasis on UX and education. The end goal is to empower users not just to use the software, but to become better investors through it.

6. Sustainability and ESG Integration

As mentioned earlier, environmental, social, and governance (ESG) considerations are becoming mainstream in investing. A notable trend is integrating ESG data and sustainability metrics into portfolio management tools. This means the software can rate or tag investments based on ESG scores, allow filtering of investment options by sustainability criteria, and even track a portfolio’s carbon footprint or social impact.

With global ESG assets projected to reach astonishing sums (for example, Bloomberg analysts projected ESG assets could top $50 trillion by 2025, roughly one-third of global AUM), the demand is high.

Transform your fintech idea into reality.

Let’s build custom investment software that empowers users and drives growth.

📩 Schedule a Free Consultation

While ESG integration might seem like a niche feature, it’s increasingly important for attracting the sizable segment of investors who want their money to align with their values. For developers, this trend involves partnering with ESG data providers and building flexible filtering/reporting tools in the software.

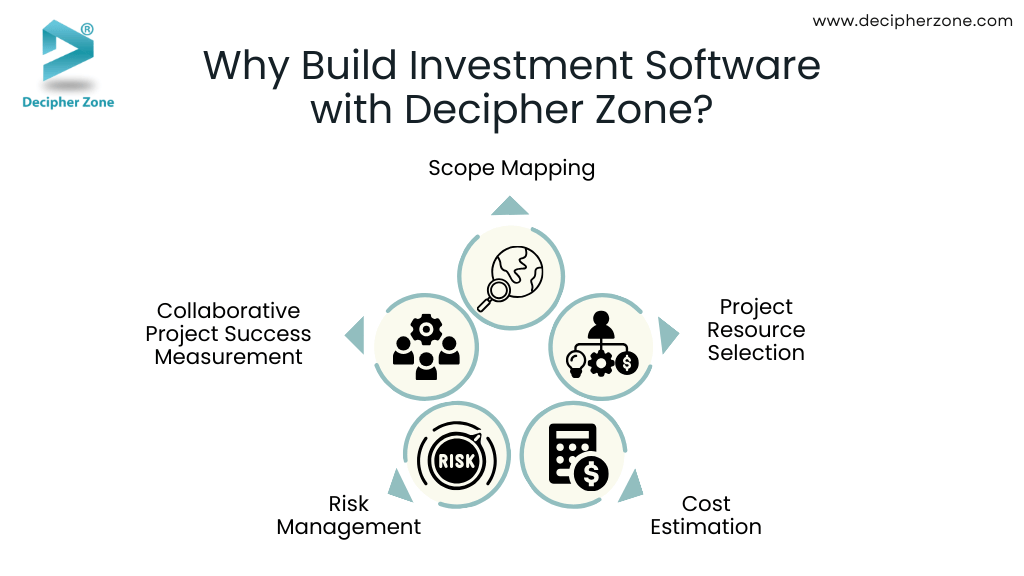

Why Build Investment Software with Decipher Zone?

Building custom investment software is a significant undertaking – but with the right development partner, it can lead to transformative results for your business. Decipher Zone is a seasoned software development company that prides itself on a collaborative, methodical approach to delivering successful investment software projects.

Our philosophy is not just to code a solution, but to partner with you through every phase of the project to ensure the final product truly meets your goals and stands the test of time.

Here’s how Decipher Zone supports clients and ensures investment project success:

Scope Mapping and Scope Creep Management

At the outset, we work with stakeholders to clearly define the project scope and requirements. Each feature and functionality is mapped to your business objectives. This rigorous planning helps prevent scope creep – the uncontrolled expansion of features.

Given that over 50% of projects experience scope creep and only 57% finish within budget, our vigilant scope management protects your project from drifting off-course. Any new ideas are evaluated through a change control process (with impact analysis and approvals) to keep the project focused and on schedule.

Project Resource Selection and Assignment

We assemble a high-caliber development team tailored to the specific needs of your investment software project. This means assigning developers, QA engineers, UX designers, and business analysts with domain expertise in fintech and the relevant technologies (whether it’s Java, blockchain, AI, etc.).

Efficient resource management is critical to project success – without it, projects often face delays or overruns. By putting the right people in the right roles, we ensure the team works effectively and can overcome challenges quickly.

Cost Estimation and Budget Optimization

Upfront, Decipher Zone provides a detailed cost estimation covering design, development, testing, and deployment. We break down costs by feature complexity and effort. Our team then actively looks for ways to optimize the budget – for example, by reusing proven frameworks, leveraging open-source components, or prioritizing an MVP feature set for phase 1. Throughout development, we track expenditures and progress closely.

We understand that only about 57% of projects finish within budget, so we emphasize cost control and transparency. If trade-offs are needed to stay on budget, we communicate proactively and help you make informed decisions.

Risk Management Throughout the SDLC

Software projects inevitably involve risks – technical uncertainties, evolving requirements, integration challenges, etc. Decipher Zone embeds risk management into every phase of the Software Development Life Cycle (SDLC). In planning, we identify key risks (e.g., performance at high user loads, regulatory compliance needs) and devise mitigation plans.

During development, we hold regular check-ins to review any new risks or issues and address them before they escalate. This proactive stance means fewer surprises. For instance, if a third-party API for market data has instability, we might implement caching or an alternative data source early on to reduce risk of downtime. Continuous testing (including security and performance testing) is another way we mitigate risk and ensure the software will perform reliably in production.

Collaborative Project Success Measurement

We believe in measuring success collaboratively with our clients. At project kickoff, we define what success looks like – not only in terms of on-time, on-budget delivery, but also metrics like end-user satisfaction, response times, or regulatory compliance achieved. During development, we use agile methodologies (like Scrum or Kanban) with frequent demos and review sessions.

This keeps you deeply involved in tracking progress and quality. We use project management tools to share sprint results, burndown charts, and other KPIs transparently. By jointly monitoring these metrics, both our team and your stakeholders stay aligned and can celebrate incremental wins on the way to the final delivery.

Project Health and Software Quality Reporting

Decipher Zone provides regular reporting on project health. This includes status reports highlighting accomplishments, upcoming tasks, any blockers, and risk updates. We also report on software quality metrics – test coverage, number of open bugs (by severity), performance benchmarks, etc. If at any point these indicators fall below agreed thresholds, we treat it as an “all hands on deck” situation to course-correct immediately.

These reports ensure you have full visibility. You’re never left wondering if the project is on track – you will know it through data and open communication. Quality is further ensured by our internal peer code reviews and QA processes that catch issues early.

.avif)

Change Request Processing and Implementation

In the fast-evolving fintech space, change is a given. Decipher Zone is flexible and responsive in handling change requests. Whether it’s a new feature idea or an adjustment due to regulatory updates, we have a formal process to evaluate change requests. We assess the impact on timeline and cost, and discuss options with you (do it now, defer to a later phase, or find an alternative solution).

Once approved, changes are documented and incorporated into the development backlog in an orderly way. Our agile approach means we can often accommodate changes without derailing the project. We’re careful to manage changes so they enhance the product’s value while preserving overall project integrity (preventing “scope creep” overload). This adaptive capability is a major reason clients trust us with long-term partnerships.

Knowledge Creation, Maintenance, and Sharing

We see every project as a co-creation of knowledge. Our team takes time to document key learnings, architectural decisions, and technical setups as we go. We maintain an internal knowledge base for the project that both our developers and your team (if desired) can access. Decipher Zone fosters a culture of knowledge sharing – for example, if our developer finds a more efficient way to implement an algorithm, that knowledge is promptly shared with the rest of the team.

Effective documentation and knowledge transfer mean that even if team members change, the project’s continuity isn’t affected. As Atlassian notes, documentation encourages knowledge sharing, which empowers the team to understand processes and what finished projects should look like. We fully subscribe to that principle, ensuring that critical know-how is never siloed.

Software Documentation Practices

Alongside development, we produce thorough software documentation. This includes technical documentation (architecture diagrams, API documentation, data models), user documentation (user guides or help files for the software’s features), and operational documentation (deployment guides, runbooks for maintenance).

Such documentation is not an afterthought for us – it’s integrated into our workflow. We understand how valuable it is in the long run: only 4% of companies always document their processes, yet good documentation can save enormous time and prevent errors. Studies show knowledge workers waste up to 2.5 hours per day searching for information when documentation is lacking.

By delivering comprehensive documentation, we ensure your team can easily maintain and extend the software after launch, and onboard new users or developers quickly. Documentation is an investment that pays off in smoother operations and easier scaling, and we make sure you reap those benefits.

Read: Popular Types of Software Development

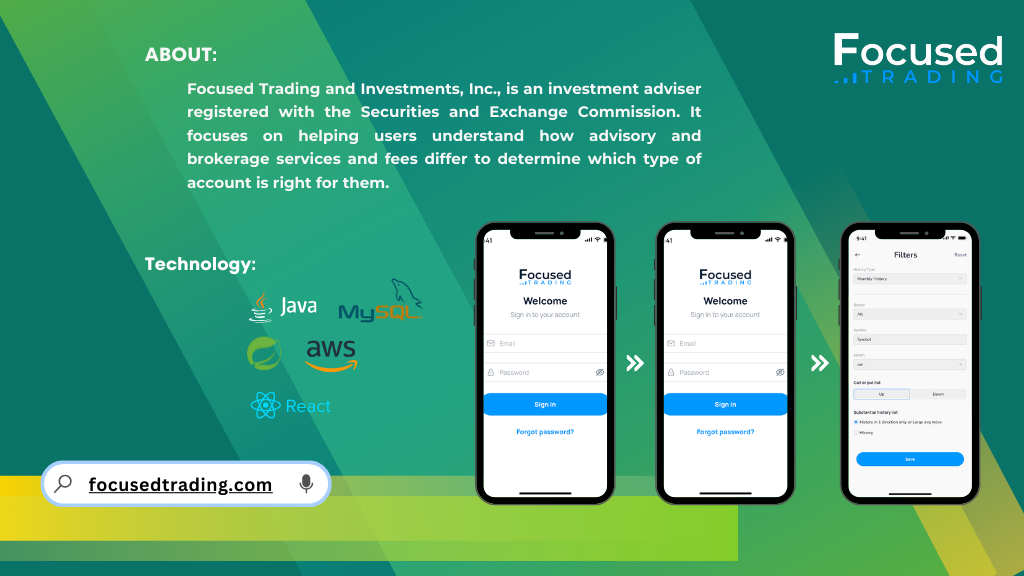

Case Study: Focused Trading Platform Development

Focused Trading, a fintech startup, collaborated with Decipher Zone to create a comprehensive trading and portfolio management platform tailored for individual investors and small investment firms. The goal was a user-friendly, secure application combining real-time trading capabilities with robust portfolio management.

Key Requirements:

-

Real-time trading and market data

-

Advanced portfolio analytics

-

Responsive web app and native mobile apps

-

Robust security and regulatory compliance

Backend:

-

Java with Spring Boot (core backend services)

-

Microservices architecture for scalability

-

Apache Kafka for real-time event streaming

Frontend:

-

Web: Angular (TypeScript), WebSocket for live data

-

Mobile: React Native for cross-platform apps

-

Highcharts for interactive financial visualizations

Database & Storage:

-

PostgreSQL for core user and transaction data

-

TimescaleDB (PostgreSQL extension) for efficient time-series data

-

Redis as caching layer

-

Data encrypted at rest (bcrypt hashing, API keys encryption)

Integrations:

-

Third-party market data API (WebSocket, REST)

-

Brokerage APIs for trade execution (OAuth-secured)

-

Payment gateway integration (ACH via banking API)

-

Modular design allowing flexible integrations

Security & Compliance:

-

OAuth 2.0 with JWT tokens

-

Multi-factor authentication (email/SMS OTP)

-

HTTPS encryption, strong password enforcement

-

Audit logs for user activities

-

AML compliance checks

-

Regular penetration tests, OWASP compliance, third-party security audits

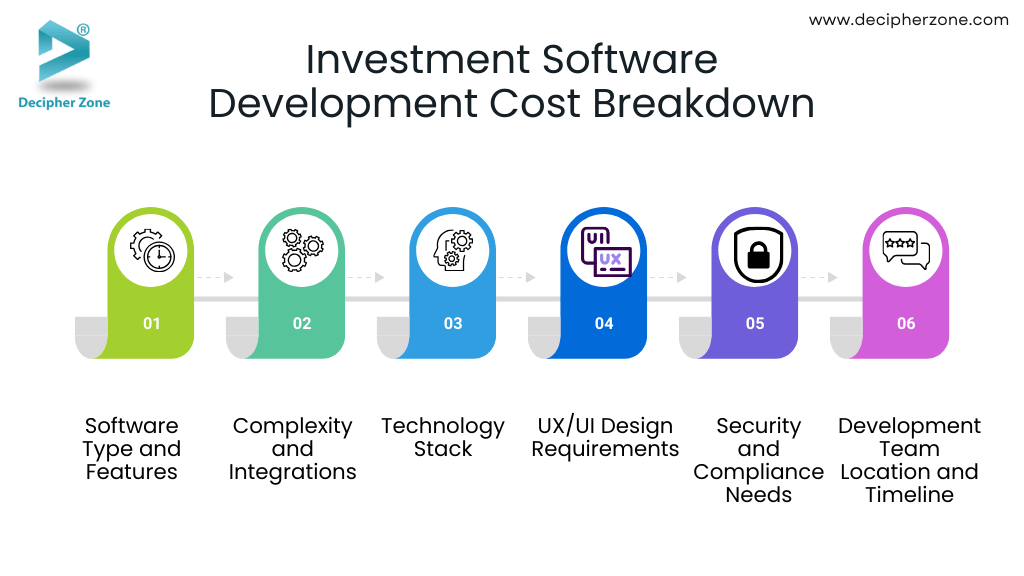

Investment Software Development Cost Breakdown (Key Factors)

One of the first questions any organization has when considering a custom investment software project is, “What will it cost?” The development cost for investment and portfolio management software can vary widely based on scope and complexity. Generally, developing a custom investment application may range from tens of thousands to a few hundred thousand dollars.

For instance, Decipher Zone’s experience (and industry data) shows that an investment or trading app’s development can start around $60,000–$80,000 for a basic version and increase for larger, more complex systems. Solutions for large banks tend to be on the higher end (up to a few hundred thousand) given their extensive requirements and integration needs.

It’s important to break down what influences these costs. Key factors include:

1. Software Type and Features

A straightforward mobile trading app with standard features (quotes, buy/sell, basic portfolio view) will cost much less than a comprehensive multi-module platform that includes portfolio management, compliance, reporting, etc.

Each additional feature or module adds development and testing effort. For example, adding a robo-advisor algorithm engine or an AI analytics component would increase scope and cost.

2. Complexity and Integrations

Does the software need to integrate with external systems (market data feeds, brokerage APIs, payment gateways, CRM systems)? Integration work can be significant. Also, some investment software must handle complex logic (e.g., options trading strategies, complex compliance rules) which can take longer to develop. High-performance requirements (like an EMS that must handle thousands of orders per second) also raise complexity.

3. Technology Stack

The choice of technology can impact cost. Using popular frameworks and languages (Java, Python, JavaScript) often has a cost benefit due to available libraries and developer expertise. If a project calls for niche technologies or ultra-high-performance languages, the specialized skills might cost more.

However, Decipher Zone always strives to choose a tech stack that is cost-effective while meeting the requirements. We also consider long-term maintenance – sometimes investing a bit more upfront for a robust, scalable architecture saves costs down the line.

4. UX/UI Design Requirements

A slick, custom user interface (especially for client-facing apps like trading apps or investor portals) requires time from skilled UX/UI designers. If you need multiple platform support (web, iOS, Android), that can increase design and development effort unless a cross-platform approach is used.

We recommend not skimping on user experience for investment apps – a well-designed UI can significantly impact user adoption and satisfaction.

5. Security and Compliance Needs

All investment software must be secure, but certain projects (like a trading platform dealing with sensitive personal data and large transactions) may require additional security features – encryption modules, penetration testing, compliance with standards like PCI DSS or ISO 27001.

Implementing and certifying these adds to cost, but is essential. Similarly, if operating in a regulated environment, building in compliance (e.g., GDPR features, audit trails, reports for regulators) will be part of the budget.

Read: Financial Software Development Cost

6. Development Team Location and Timeline

The cost will also be influenced by the composition and location of the development team. Decipher Zone offers offshore/nearshore development services which can be more cost-effective than local hiring, without compromising quality.

Additionally, the project timeline matters – an accelerated timeline might require a larger team working in parallel, thus higher monthly costs compressed in time, whereas a more flexible timeline could allow a smaller team to deliver over a longer period.

Given these factors, rather than a one-size estimate, it’s best to approach cost as a tailored calculation. In our initial consultation, Decipher Zone will work with you to outline requirements and then provide an estimated budget (often with a range, and options to scale up or down).

To illustrate typical cost brackets for finance software, consider Decipher Zone’s published figures for various fintech projects: an investment management application might range roughly $60k–$80k, whereas more encompassing banking software could be $200k+. These are ballparks – your mileage may vary based on specifics.

Read: Money Transfer App Development

It’s also worth noting the long-term costs: after development, there will be ongoing costs for hosting (cloud servers, etc.), maintenance, future upgrades, and support. We advise clients to allocate a budget (often a percentage of development cost, say 15-20% per year) for ongoing maintenance and improvements. Technology and user needs evolve, especially in finance; budgeting for iterative improvements is wise.

FAQs

What is investment management software, and who needs it?

Investment management software is a digital platform or suite of applications that helps manage financial assets and portfolios. It can include features for tracking investments, analyzing performance, executing trades, managing client information, and ensuring compliance.

How does portfolio management software improve efficiency for financial advisors?

Portfolio management software dramatically streamlines many tasks that financial advisors previously did manually. For instance, rebalancing a client’s portfolio can be done with a few clicks across all client accounts, rather than updating spreadsheets one by one. Client reporting, which might have taken hours of compiling data, is generated automatically by the software with up-to-date metrics and attractive visuals.

What are some must-have features in an investment management platform?

While features can vary based on specific use cases, some must-haves include real-time portfolio tracking, analytics & reporting, trading & rebalancing, client management, compliance and audit trails, security and customization & alerts.

How long does it take to develop a custom investment/portfolio management software?

The timeline can vary widely depending on the scope and complexity of the project. A basic investment tracking app with a few core features might take a few months (say 3–6 months) to develop an initial version. On the other hand, a full-fledged portfolio management system for an enterprise, with extensive features, integrations, and rigorous compliance requirements, could take a year or more to build and refine.

Why choose custom software development over off-the-shelf solutions for portfolio management?

Off-the-shelf solutions (existing software platforms) can be quicker to deploy, but they come with limitations. Choosing custom software development offers several advantages such as flexibility and scalability, competitive differentiation, integration, control over data and long-term cost benefits.

Conclusion

As you consider developing or upgrading your investment management software, it’s important to approach it not just as a one-time IT project, but as a long-term strategy for digital empowerment. Actionable insights moving forward would be: start with clear objectives (e.g., do you want to improve internal efficiency, attract a new client segment, or launch a new product line?), then ensure you’re incorporating the features and trends that align with those goals.

Read: Online Payment App Development

Always keep the end-user in focus – a user-friendly, trustworthy platform is key to adoption. And very importantly, choose the right development partner or team that brings both technical prowess and financial domain understanding.

In this journey, partnering with an experienced developer like Decipher Zone can make the process significantly smoother and more effective. We’ve highlighted how Decipher Zone approaches these projects – emphasizing agility, security, and customization – and why our collaboration can be an asset for your company.

Ultimately, successful investment and portfolio management software is measured by the value it delivers: happier clients, more streamlined operations, and new growth opportunities.

By investing in developing a high-quality platform today, you are setting the stage for your business to thrive in the increasingly digital and data-driven world of global finance.

Ready to embark on this journey of transformation? With the right vision and the right development expertise at your side, your investment software platform could very well become your organization’s next great success story, empowering both your team and your clients in unprecedented ways.